When it comes to buying a car, whether used or new, the real work should happen before you even set foot on the lot. Taking the time to go through a few crucial steps will make your time at the dealership a breeze. To top that, a few pre-checks could save you money, time, and the hassle of dealing with a bad auto purchase in the future.

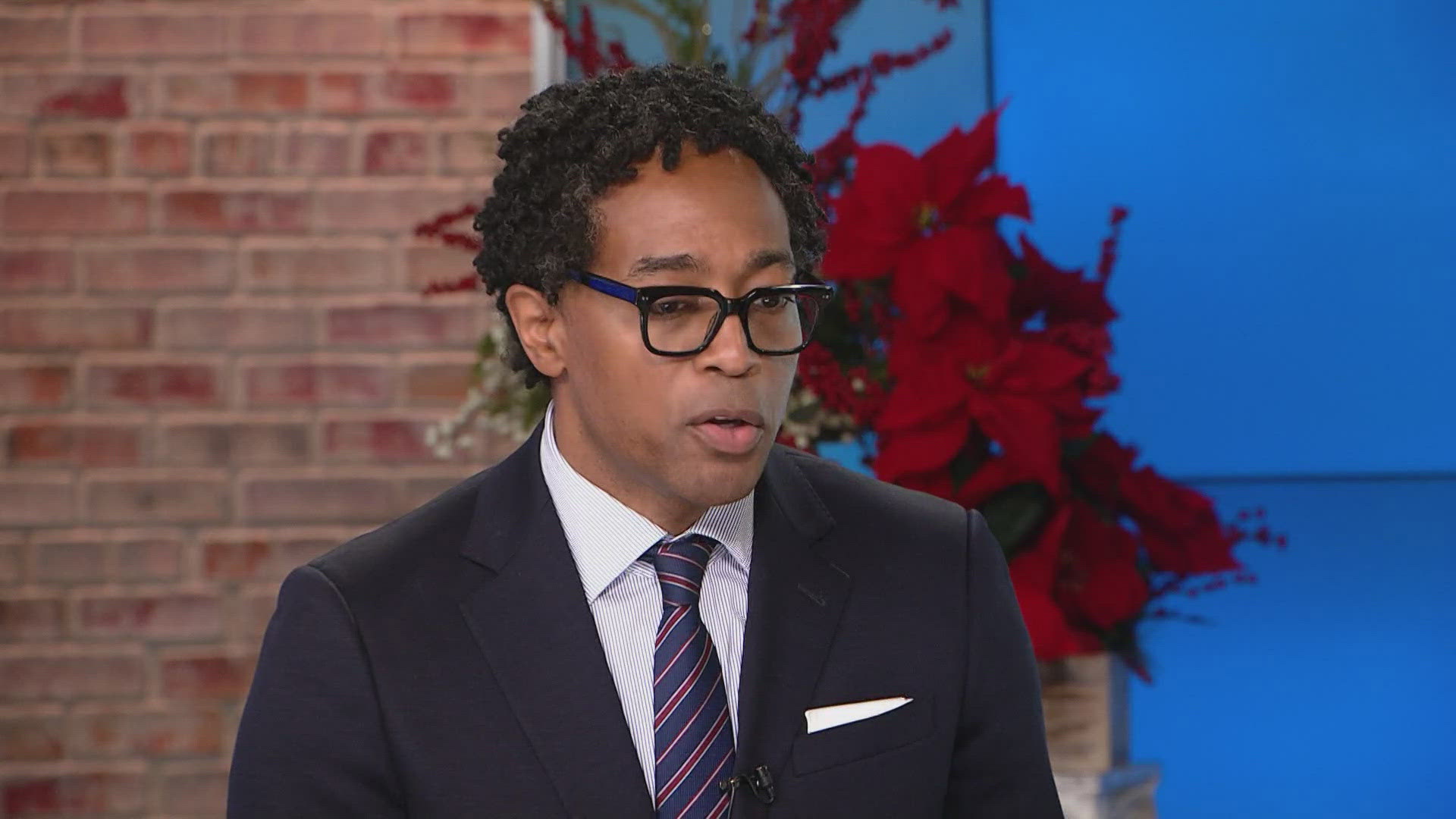

When you finally get to the dealership, Jack Nerad, executive market analyst at Kelley Blue Book, says it will pay off to come with a price in mind and all of the legwork done. The salesperson is going to ask you questions like what you’re looking for, how soon you're going to buy, if you’ve looked at other dealerships, and what you do for a living, because they want some sense that they aren’t wasting their time with you.

“Demonstrate to them in your answers that you know about your own finances and that you know largely what you want in terms of a vehicle, and it will go pretty well for you,” says Nerad.

Take the following 5 steps before you get to the dealership.

Step 1: Set a budget

Make sure to set a budget, and stay under your budget if you can. Unless you're paying cash for your car, you’ll likely finance or lease your vehicle, so you should figure out how much you can afford in a monthly payment. Generally, all your monthly debt payments — credit cards, auto loans, student loans, and mortgage — should not exceed 50% of your monthly income.

Outside of the value of the car, you should budget for the taxes and any other one-time costs such as title fees and dealer fees. It could also be beneficial to create some space in your personal budget for costs such as gas and insurance. You may also want to open an alternate savings account to allocate separate funds to recurring costs such as ongoing maintenance, car insurance, and any future repairs.

“They are going to try to sell you more stuff like the insurance, treatments, etc. Most of that stuff is not worth nearly what they are selling it to you for,” says Nerad. “It could hurt the deal that you’ve worked hard to get. Just say no to most of it or do it aware of the financing.”

Don’t forget to weigh your savings options. Consider putting down a larger down payment if you can. If you won’t need it anymore, selling or trading in your current vehicle can help you come up with extra funds for a down payment. You could also consider a less-expensive vehicle, cut back on the add-ons and features, or improve your credit score, to save on the overall cost of the vehicle.

Step 2: Get pre-approved for financing

Shopping for an auto loan is another tedious process, but you should have already completed the first step in setting your budget.

Your next step will be to shop for the best used-auto loan rates and get pre-approved for the best offer for which you are eligible. What’s better, you won’t need to leave your computer to shop for an auto loan. A growing number of online-only banks, such as LightStream, PenFed, and Capital One, offer competitive interest rates on auto loans. Your best bet is to get pre-approved for financing before you get to the dealership. Coupled with your budget, getting pre-approved will help you have an idea of what your monthly payment will be.

When shopping online for a used-auto loan, the application process will look like that of a brick-and-mortar bank, but more streamlined. You should have the following information at hand:

Your contact information: Name, address, phone number, email address

Vehicle information (if known — required for lenders that do not offer online pre-approval): Make, model, mileage, VIN, dealership information

Your financial information: Employment information, gross income, and expenses

While you’re at the dealership, negotiate the price of the car before telling the salesperson that you are approved for financing. When the salesperson tries to get you to finance the purchase through the dealership's affiliated lender, you can show them your pre-approved financing offer. There is a good chance they will try to beat your pre-approved offer, which could save you thousands of dollars in interest over the life of the loan. If they can’t beat it, you’ve already found your lowest rate and can continue your vehicle purchase.

Step 3: Choose your vehicle

Research and make a decision regarding what kind of car you want. You can use websites like Kelley Blue Book, Edmunds, and TrueCar to figure out a fair purchase price.

During your search keep in mind all of the specifications that are most important to you. You should think about how you intend to use the vehicle, not just how cool you’ll look in it. If you have a long commute to work, fuel economy may be important to you. If you have small children, having enough space for a car seat could possibly weigh in your options. If you live in the city, you might want to consider how much parking parking space you’ll have access to. Get the picture? A few other considerations:

Do you want a new car or a used vehicle?

Do you want to lease or purchase?

Do you need all-wheel drive?

Do you need a lot of cargo capacity?

How many passengers do you need to carry?

What type of driving do you do: highway, surface streets, off-road?

What safety features are important to you?

Will you drive in ice and snow?

Will you be doing any towing?

Again, think about what you need in addition to what you want.

When it comes to add-ons, remember anything you add — line items such as tire treatments, insurance, etc. — will be factored into the total purchase price and financing. The salesperson at the dealership may try to get you to purchase more than you bargained for, so come in knowing what you want to add on and where your line is drawn in your budget.

Step 4: Pick the right dealership

Next, you should find out who has the car you want within your budget. Back in the day, you would have combed through newspaper advertisements or had to visit several dealerships in person to see the cars you’re interested in. Now, with the internet, you can view multiple cars at several dealerships in your area and set filters to make sure they have what you want, for the price you want.

“More often than not the sales process is going to depend on the dealership and training of the salespeople there. If you come in knowledgeable, then you are going to be in a way better position,” says Katherine Hutt, director of communications at the Better Business Bureau.

After you get a healthy list of the dealerships in your area that have the car you want, you should check out their ratings on the Better Business Bureau website. Search for auto dealers in your area to find out which ones are BBB accredited, then look at the company’s profile to see if and why they have had any complaints filed against them.

Checking the dealerships for any serious complaints regarding their sales tactics or a negative rating will help you decide which ones are worth visiting.

Step 5: Run a background check on the car you want

Consumers for Auto Reliability and Safety (CARS) is a consumer advocacy group for the auto industry best known for leading the nationwide adoption of the lemon law, which entitles consumers to reimbursement or compensation if they are sold a vehicle that fails to perform as it was expected to within a certain amount of time.

Founder Rosemary Shahan encourages consumers to check the vehicle’s background by getting a vehicle history report through resources such as the National Motor Vehicle Title Information System, CARFAX, and AutoCheck.

When you’ve checked off these steps, pay attention to what the salesperson tells you to make sure you get the best deal.

MagnifyMoney is a price comparison and financial education website, founded by former bankers who use their knowledge of how the system works to help you save money.