ST. LOUIS — It's sticker shock for car owners in Missouri!

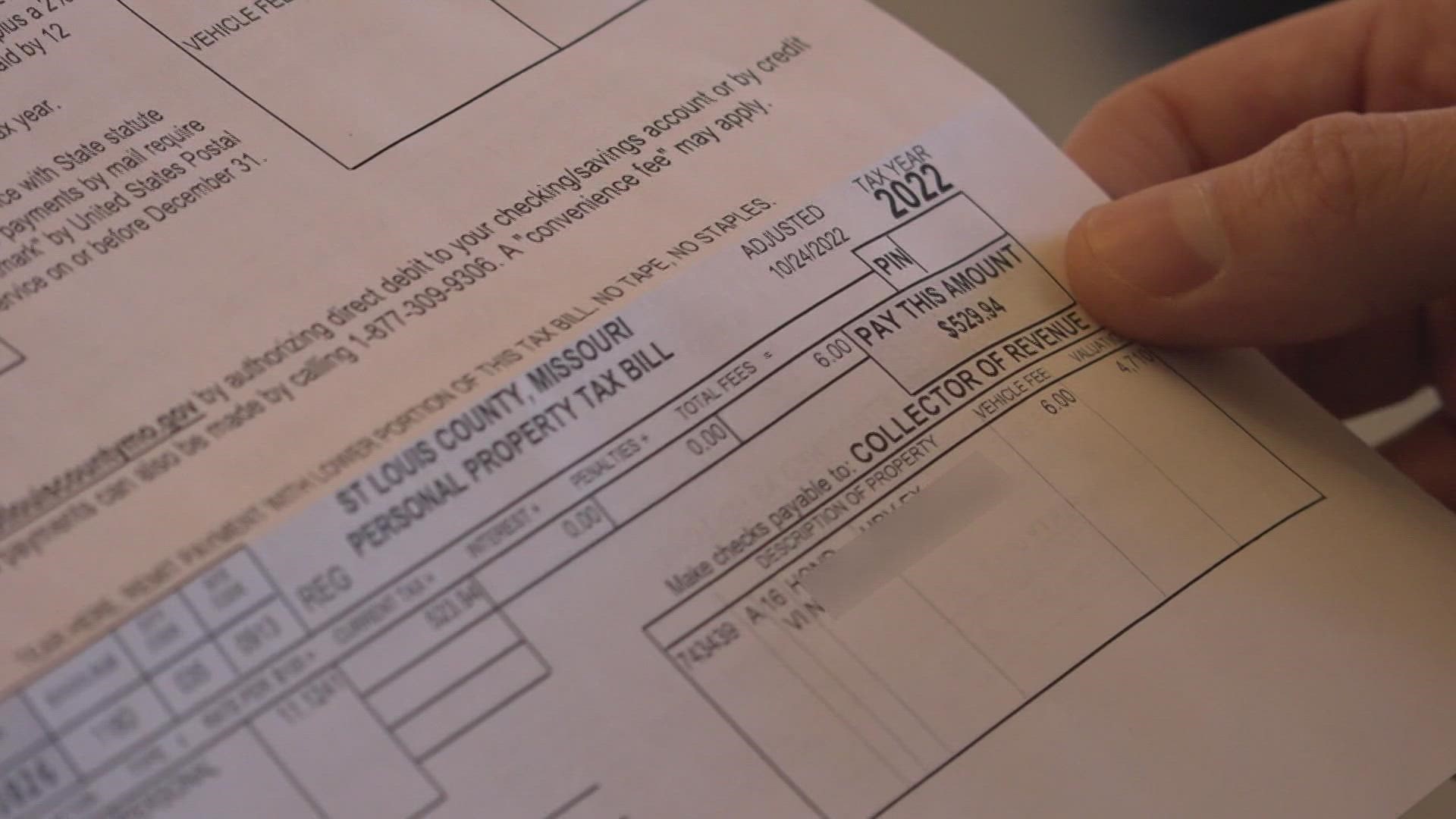

Personal property tax bills, which are being mailed to people right now, are way up this year.

St. Louis City's Assessor Michael Dauphin said he was told by the Missouri State Tax Commission that across the state, there's a 30% increase on personal property taxes compared to last year.

Pandemic problems are big reasons for this and now your pocketbook will feel the pinch.

Dauphin said the city saw a 23% increase in personal property values from 2021 to 2022.

This is quite the jump from 2020 to 2021, which saw a 5% increase.

"Each year, they declare all the vehicles, personal property that is in that property, then we assign a value to that property," he said. "This isn't normal for vehicles to be like that. Over the last five years, we haven’t seen anything like this."

According to the City of St. Louis, here are some personal property examples:

- Car

- Truck

- Motorcycle

- Boat

- RV

- Trailer

- Airplane (when declaring an airplane note if flown less than 50 hours per year)

- Motor

- Historical Vehicles

- Camper/Travel Trailer

- Conversion Van

- Bus

The reasons

Chip shortages and supply chain issues are driving up the numbers this year.

Because of this, there are not as many new cars available, which means more used cars are getting purchased and leaving fewer options.

George Zsidisin, who is the director of University of Missouri-Saint Louis's Supply Chain Risk and Resilience Research Institute, said the overall value of cars are higher than ever.

"Availability of new cars have been really constrained by supply chain disruptions and chips, that’s the bottleneck," he said. "There are fewer cars available, new and used, and those prices will increase. It affects the entire marketplace."

Dauphin also said a car usually depreciates once it is off the lot.

That is not the case anymore, which in turn, impacts your personal property tax.

"The value of used cars has increased...no question," Dauphin said.

Determining the value

By state statue, assessors have to use the National Auto Dealers Association (NADA) evaluation method for the average trade-in value.

"We take the VIN number submitted to our office, we plug that VIN number in our system, and it tells us the value. It's a rigid system," Dauphin said.

Personal property is assessed at 33 and 0.3% (one third) of its value.

For more on the assessment rate, click here.

Taxes are imposed on the assessed value.

For personal property, it is determined each Jan. 1.

Market value of cars is determined by the October issue of the NADA.

If your car is stolen or smash and grabbed, you still have to pay those taxes because you submitted that information in the beginning of the year.

Dauphin recommended reaching out to the assessor's office and taking that car off for the next year.

Personal property taxes are due no later than Dec. 31 of each year.

Dauphin said if you feel like the numbers are completely off, then you can appeal to the state's tax commission.

Due to high demand in calls and low staffing at St. Louis City, Dauphin suggested emailing as the best way possible.

"We are checking every voicemail and will call back, but we are backed up," he said.

As for the state of Illinois, it does not have personal property tax.

If there's something newsworthy happening where you live send us an email to tips@ksdk.com and our team of reporters will look into it.

As for the state of Illinois, it does not have personal property tax.

If there's something newsworthy happening where you live send us an email to tips@ksdk.com and our team of reporters will look into it.