There’s a new credit score in town: the FICO 9. The new score comes with some important changes in the way people who have medical debt or other collection items are scored.

There are dozens of different credit scores out there. So what makes the new FICO 9 so special?

For starters, FICO is the most widely used credit score in the country — 90% of all credit lenders (whether they are selling mortgages, credit cards, personal loans, and more) use the FICO score in some way.

Consumer advocates have long been pushing to make credit scoring models more lenient on people who have debt in collections or medical debt. More than 64 million Americans have some kind of medical collection record on their credit reports, according to Experian. And a whopping 99.4% of medical debts are reported to credit bureaus by collection agencies, dragging down people’s credit health in the process.

With the new score, FICO will now treat medical collections differently from non-medical collections, like credit cards. All in all, your credit score will be less damaged by a medical debt you can’t afford to pay than it would be damaged by, say, that Macy’s card payment you fell behind on.

This is a huge win for consumers. Many people who get hit with medical debt collections don’t go into debt willfully. You get sick, or you have an accident, and you really can’t control how high your medical bills are. Millions of Americans still don’t carry health insurance. And some people may not even know they have medical debt in collections.

All in all, the FICO 9 score should give responsible individuals better access to credit and lower rates on existing credit – once (and if) the changes are accepted by the industry.

Beyond medical bills, many other types of debt can end up on your credit history. For example, failure to pay your utility bill, your phone bill, your overdraft, or any other type of debt can result in your account being sold to a collection agency. And the agency will usually report the collection account to your bureau. Having these accounts can seriously harm your score.

But, with the new FICO 9 model, the older the collection item, the less impact it has on your score. If you pay back your collection items, your score will benefit.

How soon will I see my credit improve?

You may not see results right away. FICO sells its credit score to banks. Whenever a new score is introduced, a bank has to decide whether or not to upgrade. In order to make this decision, it needs to do a lot of analysis, which can take a year to 18 months. FICO says the previous version of its popular score, the FICO 8, is still the most widely used credit score out there.

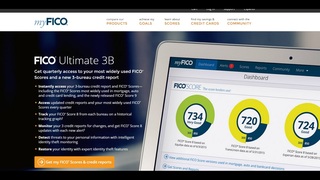

For now, the best way to see your FICO 9 score is to purchase it from MyFico.com, which charges $29.95 for monthly access to your score (although you can cancel after your first month to avoid further charges).

MagnifyMoney is a price comparison and financial education website, founded by former bankers who use their knowledge of how the system works to help you save money.