ST. LOUIS — Stimulus checks are on the way.

Some Americans saw the money automatically go into their bank accounts on Monday. By Wednesday, the treasury department said 80 million people would have the money directly deposited.

The average person is getting $1,200, but payments can go up to $2,400.

5 On Your Side already has received a lot of questions about who qualifies for the coronavirus stimulus checks, how much people can expect and what to do to make sure you get a check. That’s why we’ve teamed up with the experts at St. Louis accounting firm Anders CPAs and Advisors.

If you have a question about stimulus checks, text 5 On Your Side at 314-444-5125. This is a text-only line. We’ll work to pass along your questions to the experts at Anders. We’ll share your questions and their answers during newscasts throughout the week.

5 On Your Side will continue to update this story as more questions get answered.

Stimulus check resources:

- Timeline: When you'll get your paper stimulus check

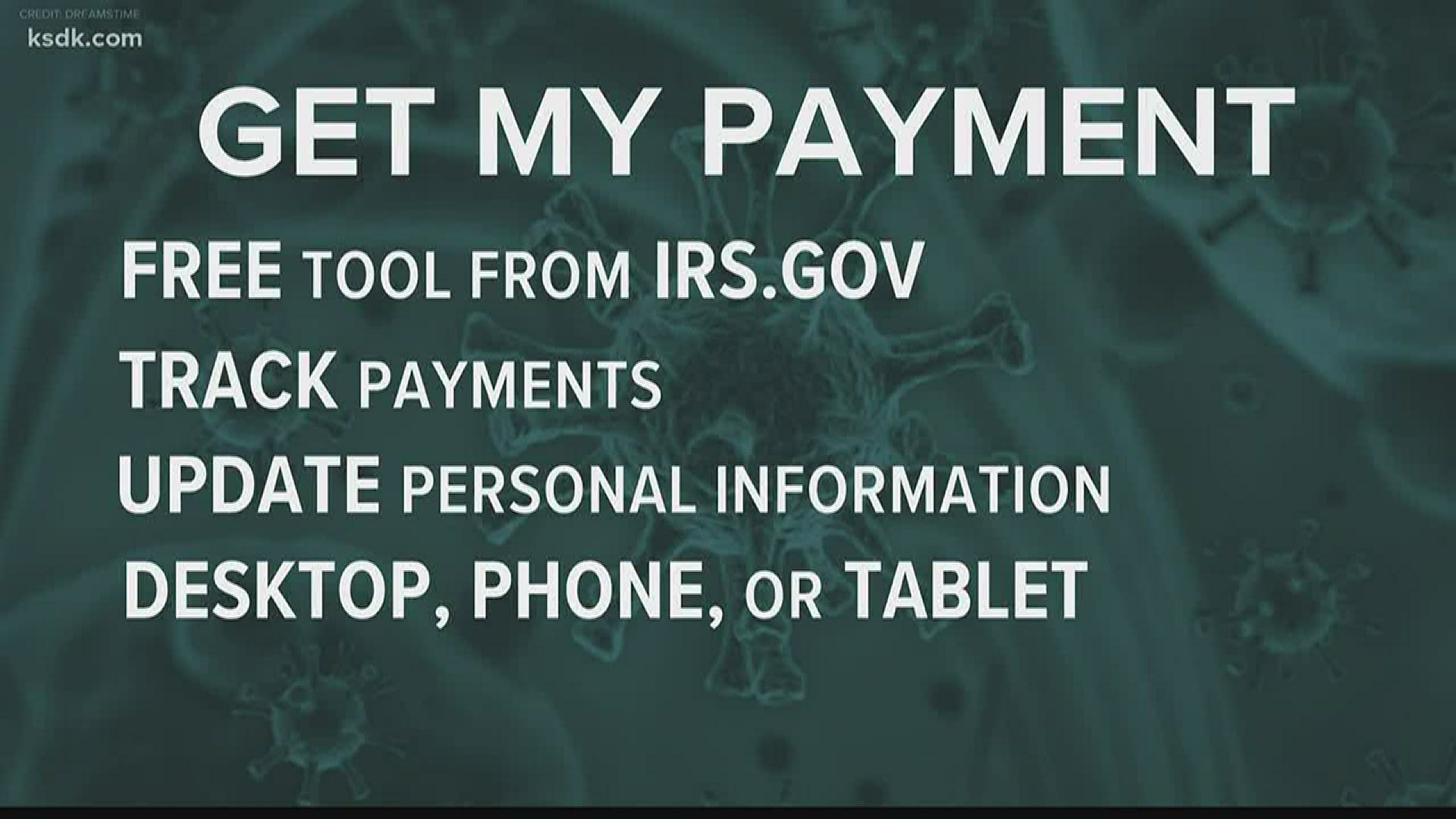

- Here's why IRS' 'Get My Payment' may not work for you

- When will stimulus checks be mailed? What to know if you're still waiting

- Find out when you'll get your stimulus check, or how to report if you don't get it

- ‘Not an insured worker’ but need to file for unemployment? Missouri has a new workaround

- If you didn't file your taxes in 2018 or 2019, here's what you need to do to get a stimulus check

- How you'll be able to find out when your stimulus check is coming

- Millions of Americans will get stimulus checks, but here's who won't

My wife and I have separate checking accounts. How do we get the check?

If you had a refund directly deposited for tax year 2018 or 2019, the IRS will deposit the payment into the bank account used on the tax return. If you elected to split your refund between several accounts, you cannot use the Get My Payment tool on the IRS website to designate which account to have your payment deposited in. The IRS will deposit the payment to the first bank account listed on Form 8888, Allocation of Refund. If your direct deposit is rejected, your payment will be mailed to the address on file with the IRS.

We claimed our 19-year-old son as a dependent in 2018. He is in college now, and we have student loans. Our household of five earns less than $75,000 a year. Am I better off claiming him as a dependent and not receiving the $1,200 from the stimulus check, or should I file separate 2019 taxes for him so he would receive the $1,200?

The IRS website lists an individual who can be claimed as a dependent on someone else’s tax return as being ineligible for the Economic Impact Payment. If you provide more than half of your son’s financial support, then he is a dependent. If he has a filing requirement, he must check the box on the tax return to indicate that someone else can claim him as a dependent.

My husband receives U.S. Railroad Retirement Board benefits. We file taxes every year, but if we have a refund, it comes in the mail. Since our return doesn't go to direct deposit, will I receive mine with his? If not, what do I need to do?

If you filed your 2019 or 2018 tax return but did not receive a refund by direct deposit, your payment will be mailed to the address the IRS has on file even if you also receive Railroad Retirement benefits by direct deposit.

You have the opportunity to provide bank account information through the IRS Get My Payment tool before your payment is processed. Direct deposit is the fastest way to receive your payment.

My mother-in-law died a month ago. This week she received her stimulus check. Can we keep it?

The CARES Act stimulus bill contained no “clawback” provisions for stimulus checks sent to a deceased individual, so you may keep the stimulus check.

Is the stimulus check just an advance on our 2020 tax refunds? If so, can we opt out?

The stimulus checks are independent of any other tax refunds and are not a pre-payment of a refund. Once they are issued, they do not have to be repaid, nor do they reduce your 2020 tax refund.

My husband and I owe taxes. Are we eligible for the stimulus check?

You can still receive a stimulus check if you have outstanding tax liabilities. As long as your income level qualifies, and you meet the other criteria of having an address, banking info on file with the IRS, etc., you will receive a stimulus check.

My former husband owes back child support. Since he’s delinquent, will he receive a stimulus check? If not, what happens to the $1,200?

In the CARES Act, Congress specified that past-due child support is the only obligation that would subject stimulus payments to the Treasury Offset Program (TOP). The TOP will still be legally allowed to seize your stimulus payment if you’re behind on child support and your state has referred those payments to TOP for collection.

For divorced couples with children who alternate filing with their children as dependents, who will get the stimulus check?

The checks are based on the dependents claimed on the tax return the IRS uses to calculate the stimulus amount. As such, whoever claimed the children in that year will receive the $500 payment for that child.

Will people with disabilities who receive SSI/SSDI and don't file taxes receive a stimulus check?

Yes, they will. The IRS has their mailing and bank information on file from the Social Security Administration, and no further action is required to receive the stimulus check. If you receive SSI/SSDI and have dependents, you will have to go online to the IRS website to provide your dependent’s information so that you will receive the maximum stimulus payment for your family.

My husband passed away in December, and we jointly filed 2018 and 2019 taxes. I got a $2,400 stimulus check. Do I have to repay $1,200 of it?

As it stands today, the IRS is only looking at the filing status and Adjusted Gross Income of taxpayers for calendar 2019 (or 2018 if necessary). The IRS is not requiring any repayment once stimulus money is received based on the tax return relied on to determine the amount. As such, if you receive $2,400 based on the tax return the IRS reviewed, you will not be required to repay any of it.

If I have a payment plan with the IRS and payments are being debited from my bank account, do I need to do anything further to get my stimulus check?

No, nothing further is needed as the IRS payment plan and the IRS stimulus checks are not interrelated. The CARES Act actually suspends almost all efforts to garnish tax refunds to repay debts, including those to the IRS. If you contact the IRS, they are offering to suspend installment plan payments from April 1 – July 15. If you would like to take this option, we would recommend contacting your bank to stop the automatic draft of payments to any payment plan.

Can people experiencing homelessness qualify for a stimulus check if they don't have a mailing address?

While anyone can qualify for the stimulus check, the individual must fall under certain income limitations, have a valid Social Security Number and cannot be claimed as a dependent by someone else. However, individuals will need to have their bank account information and mailing address on file with the IRS to receive payment, which can be updated online. Those who are not sure if they have this information on file with the IRS or have not filed an income tax in the past two years can update their information with the IRS at irs.gov/coronavirus/economic-impact-payments.

As such, if a person experiencing homelessness does not have a current address and does not have access to one by way of a friend or family member, we would recommend they contact their nearest homeless support organization to see if they can help. The same advice applies if they do not have access to a bank account.

Can college students who have jobs and filed taxes for 2019 receive a stimulus check?

If children, including some college students, can be claimed as a dependent on someone else’s return, they are not eligible for the stimulus check. Given this, any college student claimed as a dependent would not receive a check. However, if you are not claimed as a dependent (whether you are a college student or not), you could qualify if you meet the other criteria. This has been a common question among our clients, and you can find this and additional answers like these at our COVID-19 Resource Center at our website anderscpa.com.

If I had my taxes prepared by a company that issues a refund to a debit card, will my stimulus check be deposited to it or to my checking account?

While it appears the IRS contemplated issuing stimulus payments via debit card, it was decided the stimulus checks will only be directly deposited into bank accounts on file with the IRS or mailed to taxpayers at their last address of record if they do not have a bank account on file with the IRS. As such, if your last bank account of record with the IRS is the account used by your tax preparer’s bank for your debit card refund, our advice is to update your bank account information on file with the IRS to have your stimulus check directed to a different account. This can be done on the IRS Economic Impact Payments website.