ST. LOUIS — One-point-four billion dollars’ worth of COVID-19 stimulus checks will never be cashed by the people they're addressed to, because they're dead.

That’s according to a new report from the Government Accountability Office, which found at least one million payments of up to $1,200 each went out as part of the CARES Act.

One of those went to Maureen Donaho’s mother, who died in February.

“Actually we joked about it before we received it and said watch we’ll get one— and then we did. So, we weren’t surprised but we just assumed we had to return it,” she said. “When you're going through that grieving process and then you get this in the mail and then you don't know what to do with it, it's just an irritant."

The GAO said the mistake came with the treasury rushing to get the checks out quickly, not lining up payouts with death records. The mistake cost the government about 0.5% of their overall coronavirus relief spending so far, but still, the IRS is clarifying, you must return money paid out for people who are deceased, if they died before they could cash the checks themselves.

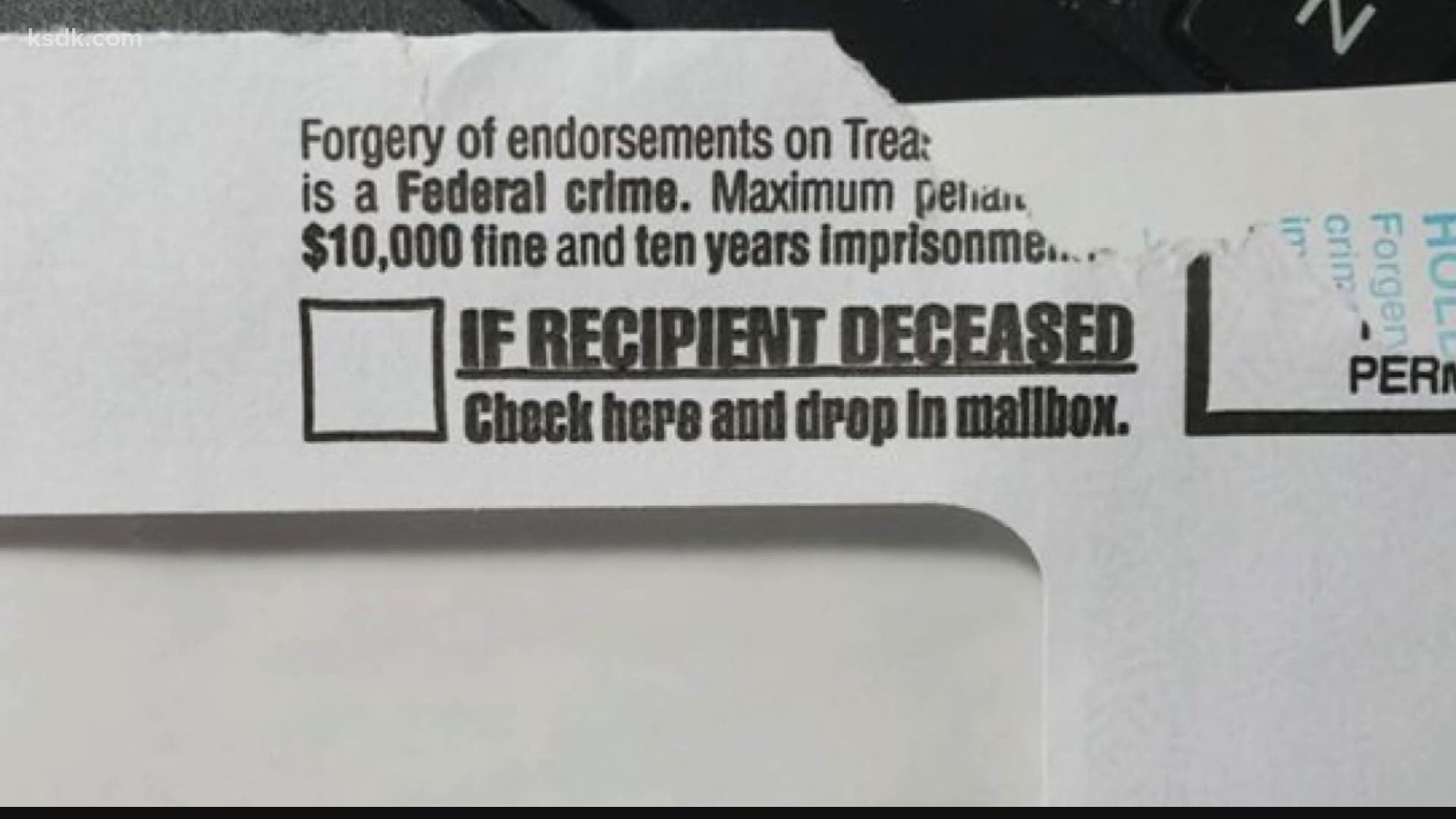

So, how do you do that? The box to mark on the envelope to return it if the recipient is deceased doesn't always work. Donaho said a friend tried to return the check sent to her late father and it just came back in the mail, so she was hesitant to do the same.

Here are the updated IRS instructions.

If the payment was a paper check:

Write "Void" in the endorsement section on the back of the check.

Mail the voided Treasury Department check immediately to the appropriate IRS location listed below.

Don't staple, bend or paper clip the check.

Include a brief explanation stating the reason for returning the check.

If the payment was a paper check and you have cashed it, or if the payment was a direct deposit:

Submit a personal check, money order, etc., immediately to the appropriate IRS location listed below.

Write on the check/money order made payable to “U.S. Treasury” and write 2020EIP, and the taxpayer identification number (social security number, or individual taxpayer identification number) of the recipient of the check.

Include a brief explanation of the reason for returning the EIP.

Missouri residents should mail their checks to:

Kansas City Internal Revenue Service

333 W Pershing Rd.

Kansas City, MO 64108

Illinois residents should mail checks to:

Philadelphia Internal Revenue Service

2970 Market St.

Philadelphia, PA 19104

For a list of other states' addresses, check out the IRS website.

In the case the payment was made to joint filers and one spouse was alive at the time of the payment, only the portion for the person who had died needs to be returned.

The IRS doesn't have a plan right now to reach out to those who mistakenly received a check for someone who's died, but with the release of this new information and GAO recommendation, the department has said it will determine the best way to do that. The IRS also has not defined what type of penalty someone may receive for keeping the money meant for a deceased loved one.