ST. LOUIS — Missouri is holding its back-to-school sales tax holiday this weekend.

The annual three-day event will waive state sales tax on certain items students might need for the upcoming school year, and you don't have to be a student or a Missouri resident to take advantage.

From 12:01 a.m. Friday to 11:59 p.m. Sunday, state sales taxes will not apply on purchases of items like school supplies, clothing, computers and computer accessories.

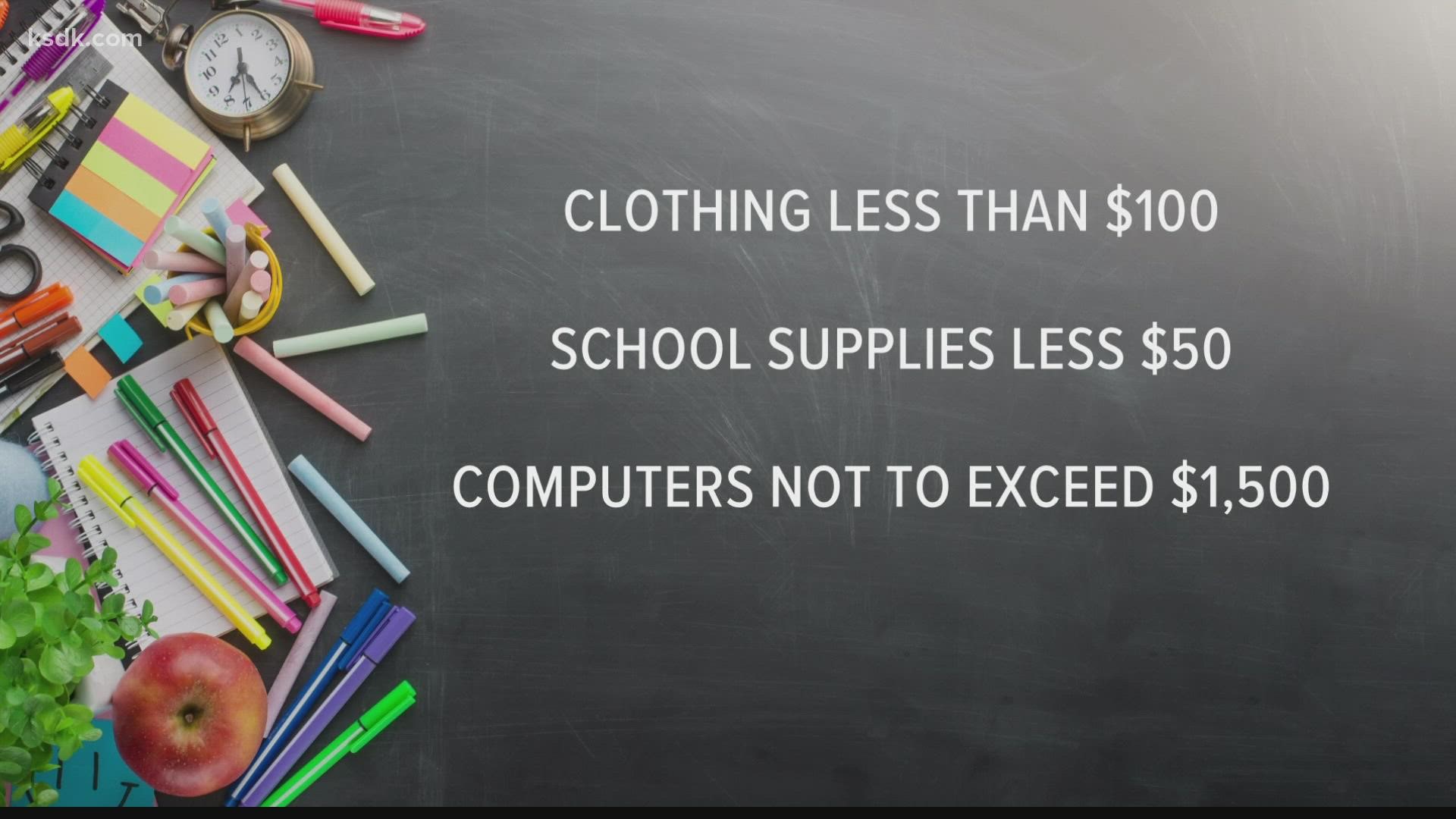

The tax exemption is limited to:

- Clothing – any article having a taxable value of $100 or less

- School supplies – not to exceed $50 per purchase

- Computer software – taxable value of $350 or less

- Personal computers – not to exceed $1,500

- Computer peripheral devices – not to exceed $1,500

- Graphing calculators - not to exceed $150

In addition to state sales taxes being waived, some counties and cities are also waiving sales taxes. To max out your tax savings, look for cities and counties joining the tax-free weekend.

The following jurisdictions in the St. Louis area are not waiving their own sales taxes:

Counties:

- Iron

- Phelps

- Pike

- Reynolds

- St. Charles

- St. Francois

- Ste. Genevieve

Cities:

- Alton

- Bellerive Acres

- Berkeley

- Beverly Hills

- Black Jack

- Brentwood

- Bridgeton

- Byrnes Mill

- Cape Girardeau

- Charlack

- Clayton

- Cool Valley

- Crestwood

- Crystal City

- Des Peres

- Desloge

- DeSoto

- Edmundson

- Elsberry

- Farmington

- Ferguson

- Festus

- Frontenac

- Greendale

- Hawk Point

- Ironton

- Kirkwood

- Ladue

- Leadington

- Manchester

- Maplewood

- Marlborough Village

- Moscow Mills

- Mount Vernon

- New Haven

- New Melle

- Northwoods

- Oakland

- Overland

- Owensville

- Pevely

- Richmond Heights

- Rock Hill

- Shrewsbury

- St. Ann

- St. Mary

- St. Peters

- Ste. Genevieve

- Town & Country

- Twin Oaks

- University City

- Velda

- Warson Woods

- Webster Groves

There are also a number of other tax jurisdictions that have opted out of the tax-free weekend. You can find a full list here.

For more information about tax-free weekend, click here.