ST. LOUIS — With so many of us running on fumes after the past few weeks, insurance agencies are providing an unexpected boost.

"Just a lot of emotions: thank yous, hugs through the phones. It's been an incredible experience,” said Daniel Fowler.

He and other American Family Insurance Agents have been delivering the good news this week that the company is sending $50 per insured personal vehicle back to policy holders.

You don’t have to have lost your job. The money isn’t taxed. It’s not a credit towards future payments. It’s simply a check that will be sent out in the next few weeks.

“There’s no gimmick, there's no catch to this, it is real,” said Fowler. “I can give you my word on that.”

This week Allstate Insurance also announced it'd be paying policy holders at least 15% of their premium, direct deposited.

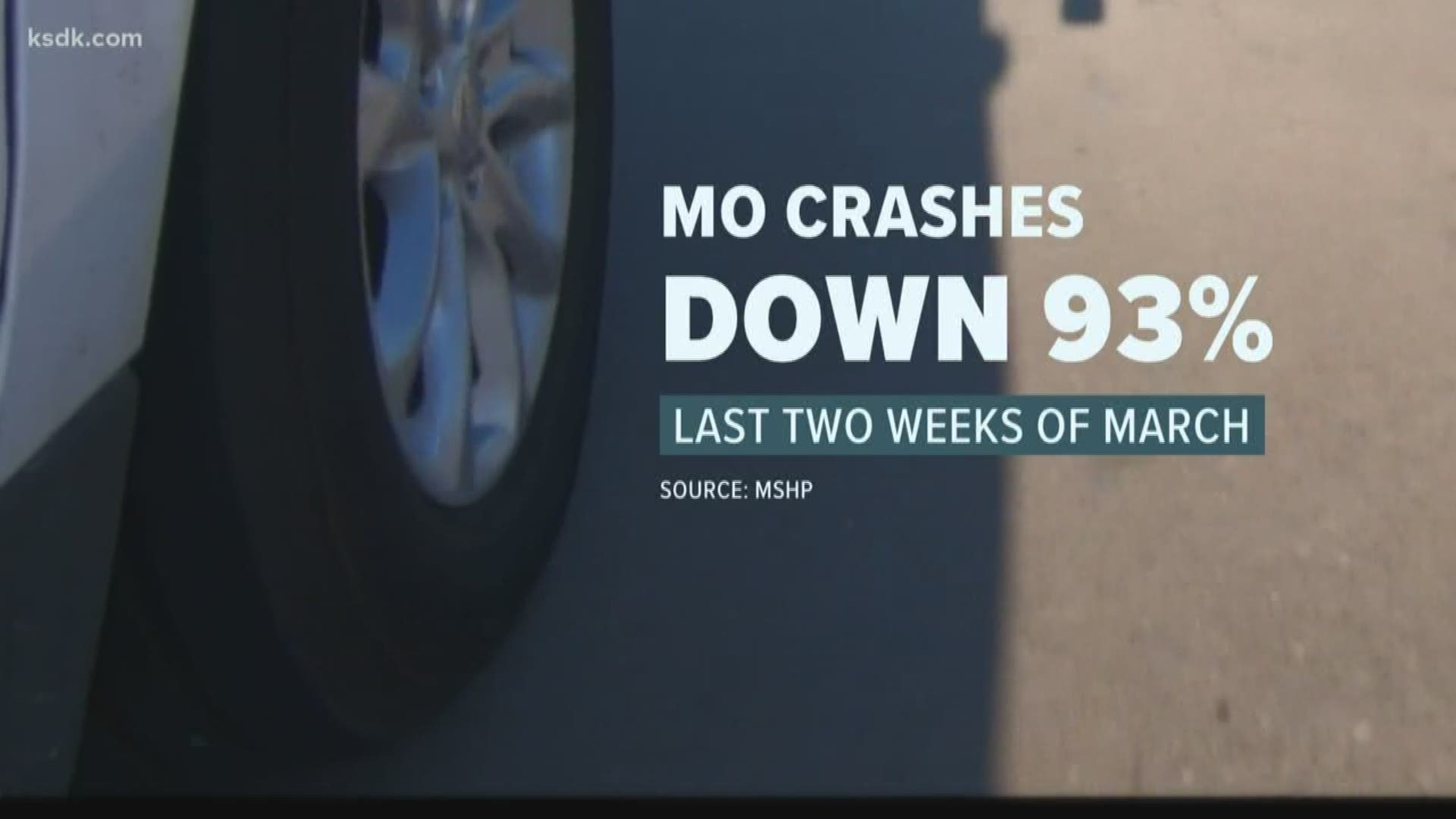

Why? Fewer people on the roads means fewer crashes that insurance companies have to pay out for, typically.

In Missouri, crashes were down 93% for the last two weeks in March. More specifically, they were down 97% in St. Louis, 95% in St. Louis County, and 94% in St. Charles County.

“It is the right thing to do and we're doing it because we do see fewer accidents,” said Fowler.

It’s not necessarily a hard thing for insurance companies to do right now though. The industry watchdog group Valchoice estimates car insurance companies will save $100 billion in payouts because of reduced driving during social distancing.

No matter who your provider is, if you're driving a lot less right now, call them. You could probably adjust your policy to pay a lot less, too, since you often pay rates based on your mileage.

“I think that all agents want to do the best they can for their client, to give them the best price for the best value,” said Fowler. “So, it's a great conversation to have on the phone with somebody.”

And if people still work from home — or drive less — after this all passes? This new normal could still yield some perks.

“You will see lower rates down the road, assuming that that holds up,” explained Fowler.