ST. LOUIS — Congress is expected to pass the $2.2 trillion stimulus bill on Friday, two days after the Senate passed it.

There's obviously a lot that goes into a bill of this size, and we've heard from a lot of people with questions about who, exactly, will get money and how much.

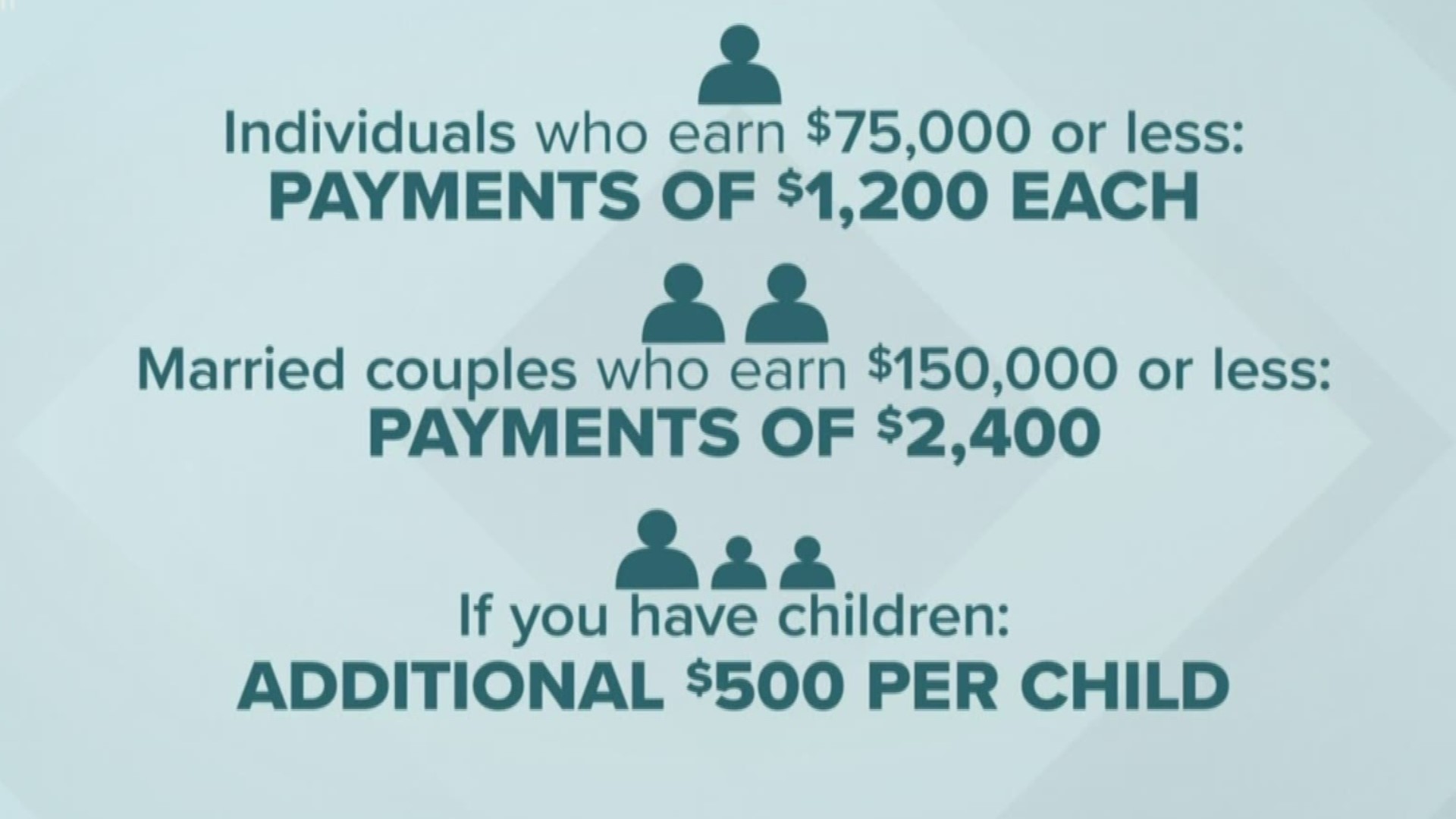

So, you've probably heard about the $1,200 payment coming from the government. Anyone making less than $75,000, or a "head of household" making less than $112,500 will get the full $1,200.

Couples making less than $150,000 will get $2,400.

And anyone with children who is getting a payment gets an extra $500 per child.

The White House wants the IRS to send you this money by direct deposit in the next three weeks. If you've received a federal tax refund in the past two years through direct deposit, the IRS will send your money to that account.

If not, you'll get a check in the mail.

Your mailing address — as well as your income — will be based on your 2019 taxes. If you haven't filed your 2019 taxes yet, the IRS will work from your 2018 taxes.

If you were not eligible based on your 2018 income but your income was lower in 2019, then you may want to hurry up and file your 2019 taxes to make sure you get your stimulus payment.

The same goes if you've moved since filing your 2018 return. That way the check won't go to the wrong address.

What if you're on Social Security or one of its plans like disability and didn't make enough to file taxes? Reports out of Washington are if you get a 1099 form from Social Security, you will get the stimulus payment of at least $1,200.

This bill changes unemployment, too.

First, a lot more people will be eligible. Part-time workers and freelance workers, like Uber or Lyft drivers, are all now eligible.

Or, if you just started a job and got laid-off because of the coronavirus, you can still get unemployment under this stimulus plan.

And their benefits will be bigger, too.

The plan extends the time you can be on unemployment by 13 weeks, which brings it to a max of 39.

And for the first four months, it adds an additional $600 a week to state unemployment checks, bringing the benefit closer to an average week's pay in America.

Another question some have asked is whether the one-time $1,200 payment is taxable. The answer is 'no.' This payment will not affect your 2020 taxable income.

All of this is expected to pass the House on Friday, and the president said he will sign it. Democrats in the House said this might not be the last stimulus plan to offer relief from COVID-19.