WASHINGTON — 5 On Your Side has received many questions about the IRS’ ‘Get My Payment’ portal.

We put together a list of the frequently asked questions that are on the IRS’ page.

On April 26, the IRS said it has made enhancements to Get My Payment to deliver an improved and smoother experience.

“We delivered Get My Payment with new capabilities that did not exist during any similar relief program, including the ability to receive direct deposit information that accelerates payments to millions of people,” said IRS Commissioner Chuck Rettig. “These further enhancements will help even more taxpayers. We urge people who haven’t received a payment date yet to visit Get My Payment again for the latest information. IRS teams worked long hours to deliver Get My Payment in record time, and we will continue to make improvements to help Americans.”

What does it mean when Get My Payment says, ‘need more information?’

You are eligible for an Economic Impact Payment (EIP), but the IRS does not have your direct deposit information to send your payment electronically. You should provide your bank information once you have properly verified your identity. Make sure the routing number, account number and account type are correct. You can find this information on one of your checks, through your online banking applications or by contacting your financial institution directly. Direct deposit is the fastest way to get your EIP.

If you choose not to provide your bank information or prefer to receive your EIP by mail, your payment will be sent to the address we have on file for you.

What does it mean when Get My Payment says, 'please try again later’?

Your account has been locked. You will be able to access the application after 24 hours have passed. Please do not contact the IRS.

If I filed jointly with my spouse, does it matter whose information I use for Get My Payment?

Either spouse can use Get My Payment by providing their own information for the security questions used to verify their identity. Once verified, the same payment status will be shown for both spouses.

I am not required to file a tax return, can I still use Get My Payment to check my payment status?

Depending on your specific circumstances, it may not be possible for you to access Get My Payment if you usually do not file a tax return. If your identity cannot be verified when answering the required security questions, you will not be able to use Get My Payment.

I receive a Form SSA-1099 or RRB-1099 and file a tax return. Can I use Get My Payment to check my payment status?

Yes, you will be able to use Get My Payment to check the status of your payment after you verify your identity by answering the required security questions.

I receive a Form SSA-1099 or RRB-1099 and do not file a tax return because I don’t meet the income requirement to file. Can I use Get My Payment to provide my bank information to receive my EIP by direct deposit?

You will not be able to use Get My Payment to provide your bank account information because you did not file tax returns for 2018 or 2019. The IRS will use the information on the Form SSA-1099 or Form RRB-1099 to generate your payment. You will receive your payment as a direct deposit or by mail, just as you would normally receive your benefits.

If I have an Individual Taxpayer Identification Number (ITIN), can I use Get My Payment?

You can access Get My Payment using an ITIN, but in most cases, the law does not allow an Economic Impact Payment (EIP) for individuals who file a return using an ITIN. The only exception is when two spouses file a joint tax return and either spouse is a member of the U.S. Armed Forces at any time during the taxable year, in which case only one spouse needs to have a valid SSN.

How long will it take for my payment status to change?

Updates to your payment status are made no more than once per day.

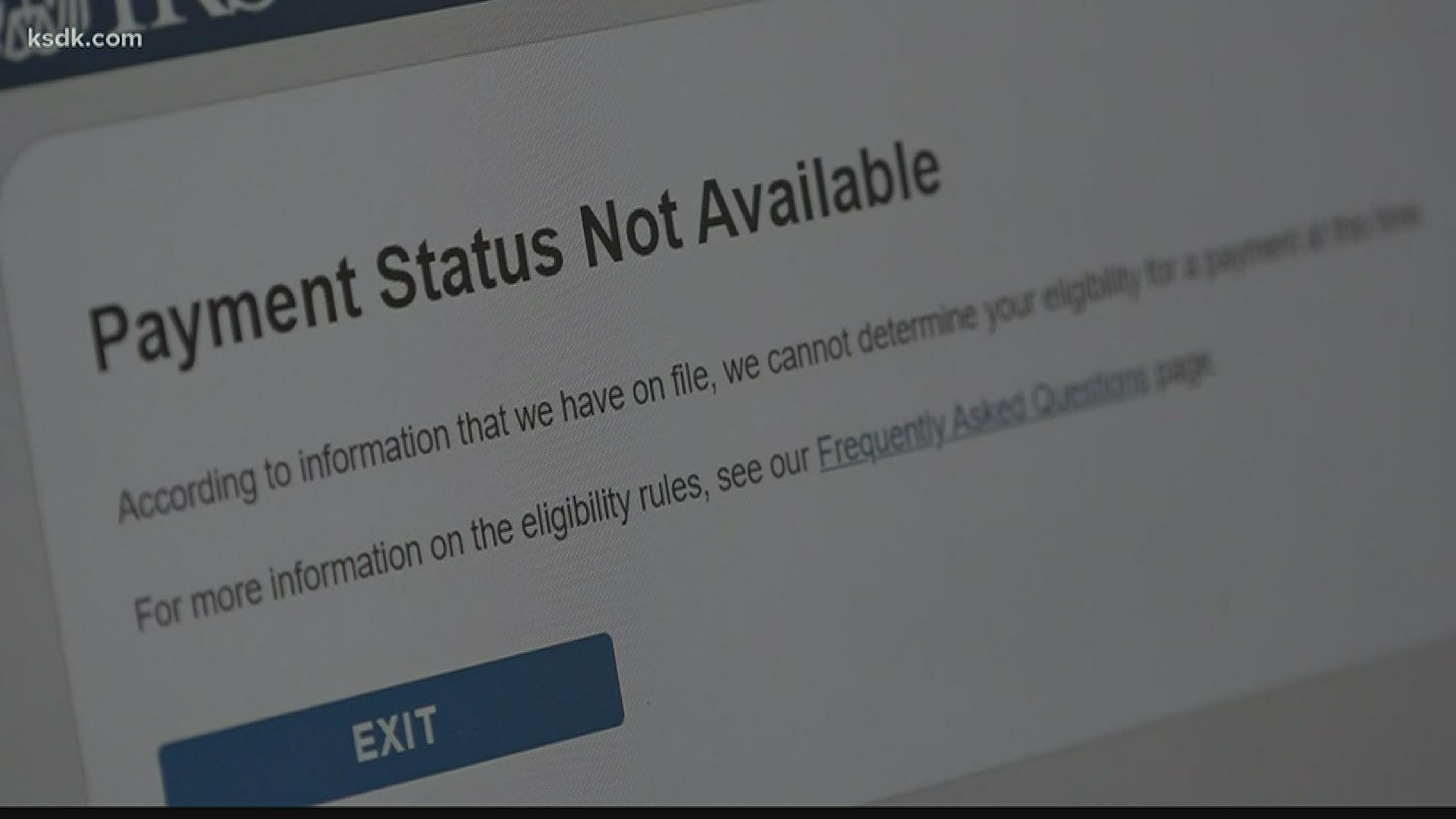

Why am I getting ‘payment status not available’?

The Get My Payment application will return ‘Payment Status Not Available’ for several reasons, including:

You are required to file a tax return, but:

The IRS hasn't finished processing your 2019 return.

The application doesn't yet have your data; the IRS is working on adding more data to allow more people to use it.

You don't usually file a return, and:

You used Non-Filers: Enter Payment Info Here but the IRS hasn't processed your entry yet.

You receive an SSA or RRB Form 1099 or SSI or VA benefits; information has not been loaded onto IRS' systems yet for people who don’t normally file a tax return.

You’re not eligible for a payment.

The IRS said it updates Get My Payment data once per day, overnight so there is no need to check more often.

Can I use Get My Payment to check the direct deposit status if I changed my payment method to direct deposit?

Yes. You can use Get My Payment to check the status of your direct deposit after you provided your bank information. Updates to your payment status are made no more than once per day.

If Get My Payment is unavailable, will Where’s My Refund or View Your Account allow me to provide my bank information?

No, Where’s My Refund and View Your Account will not allow you to provide your bank information for purposes of your payment. Get My Payment is the only option available to enter your bank information to receive your payment through direct deposit instead of by mail if your payment has not already been scheduled. If Get My Payment is not available at the time you access it, you will need to try again later.

My address is different from the last tax return I filed. Can I change it using Get My Payment?

No. Get My Payment will not allow you to change your address. To change your address:

If you have not filed your 2019 tax return, enter your new address on your return when you file. We update our records when your return is processed. File electronically to ensure your return will be processed more quickly.

If you have filed your 2019 tax return and you did not receive a refund via direct deposit, your payment will be mailed to the address we have on file for you. This is generally the address on your most recent return or as updated through the United States Postal Service.

MORE CORONAVIRUS STORIES