ST. LOUIS — As the IRS prepares to send billions to Americans in response to the coronavirus pandemic, one vulnerable group said they're being left out: college students.

"When we first heard about it, we thought everybody was getting $1,200 and we were really excited about it, and when it came out that we weren't included we were kind of disappointed," said Dillon Scott.

Scott is a St. Louis native who attends the University of Miami. Like many of his peers, the pandemic has put him in a lose-lose situation.

"I like lifting the burden on my parents as much as possible and without having a stable job, I don't really know if I'm gonna have a job this summer because of what's going on with corona," said Scott.

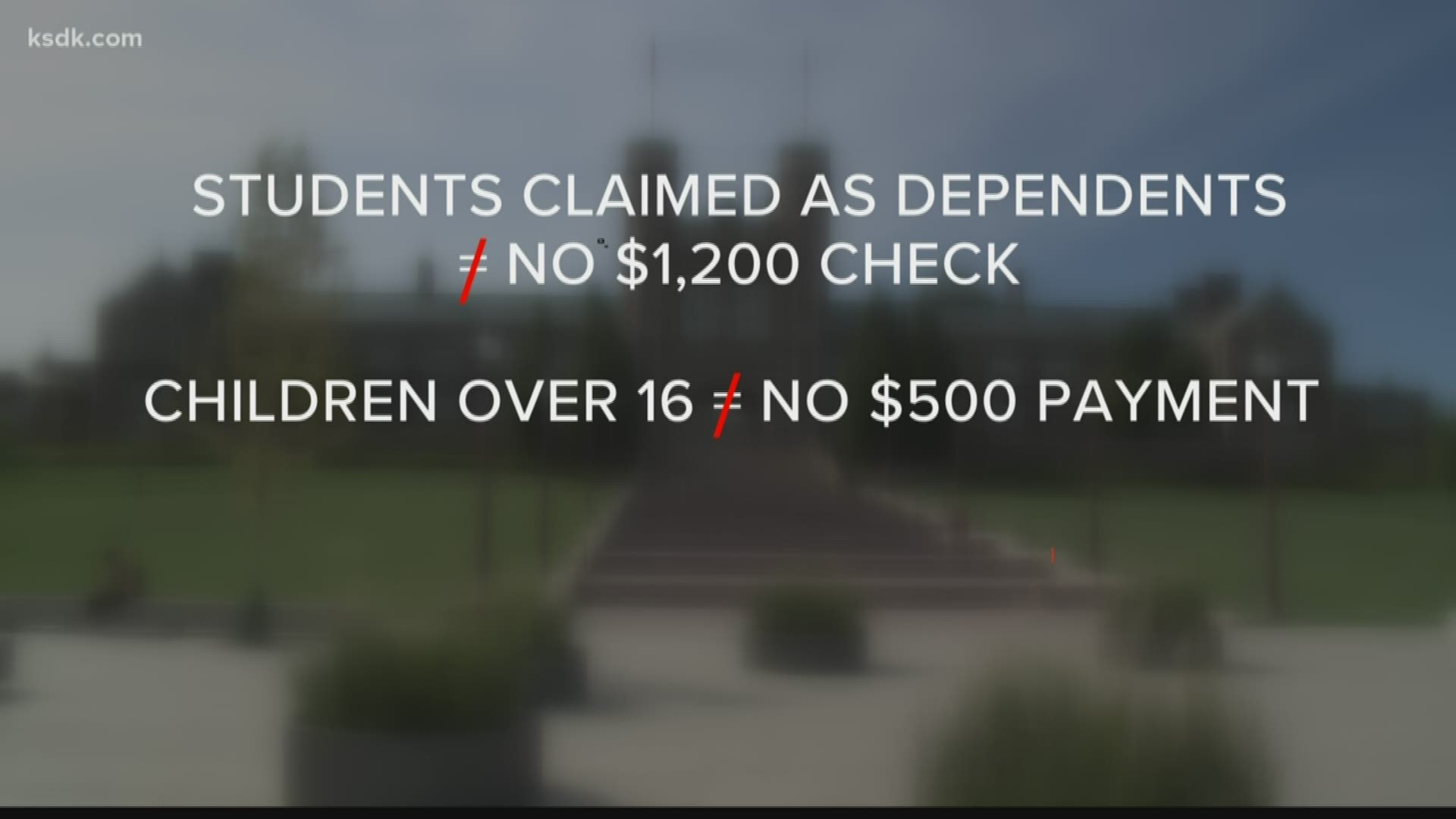

Here's how the stimulus package breaks down for college students.

If college students are claimed as dependents on their parents' tax returns, they're out of luck. They can't get the $1,200 check themselves, and because they're older than 16, their parents won't get the $500 child payment.

"I think this money obviously is not going to fix all of the economic issues that we run into, but it is going to go far in providing a bit of a buffer," said attorney Lilian Davis, shareholder at Polsinelli.

Davis said the stimulus package is meant to help those out of work and small businesses that are struggling.

"I think it's pretty apparent through all of this that probably the most vulnerable group of people are the hourly workers or the workers who can't do their work from home," said Davis.

"I feel like the whole country is going to be happy when all of this is over," said Scott.

College students who were laid off because of COVID-19 are still able to apply for unemployment assistance.

More information on the stimulus checks:

- Social Security recipients won't have to file tax return to get stimulus check after all

- Stimulus check calculator: See how much you'll likely be getting

- 5 benefits from the CARES Act you need to know about besides the stimulus check

- Will you get a stimulus check if you receive Social Security or disability, or didn’t file a tax return?