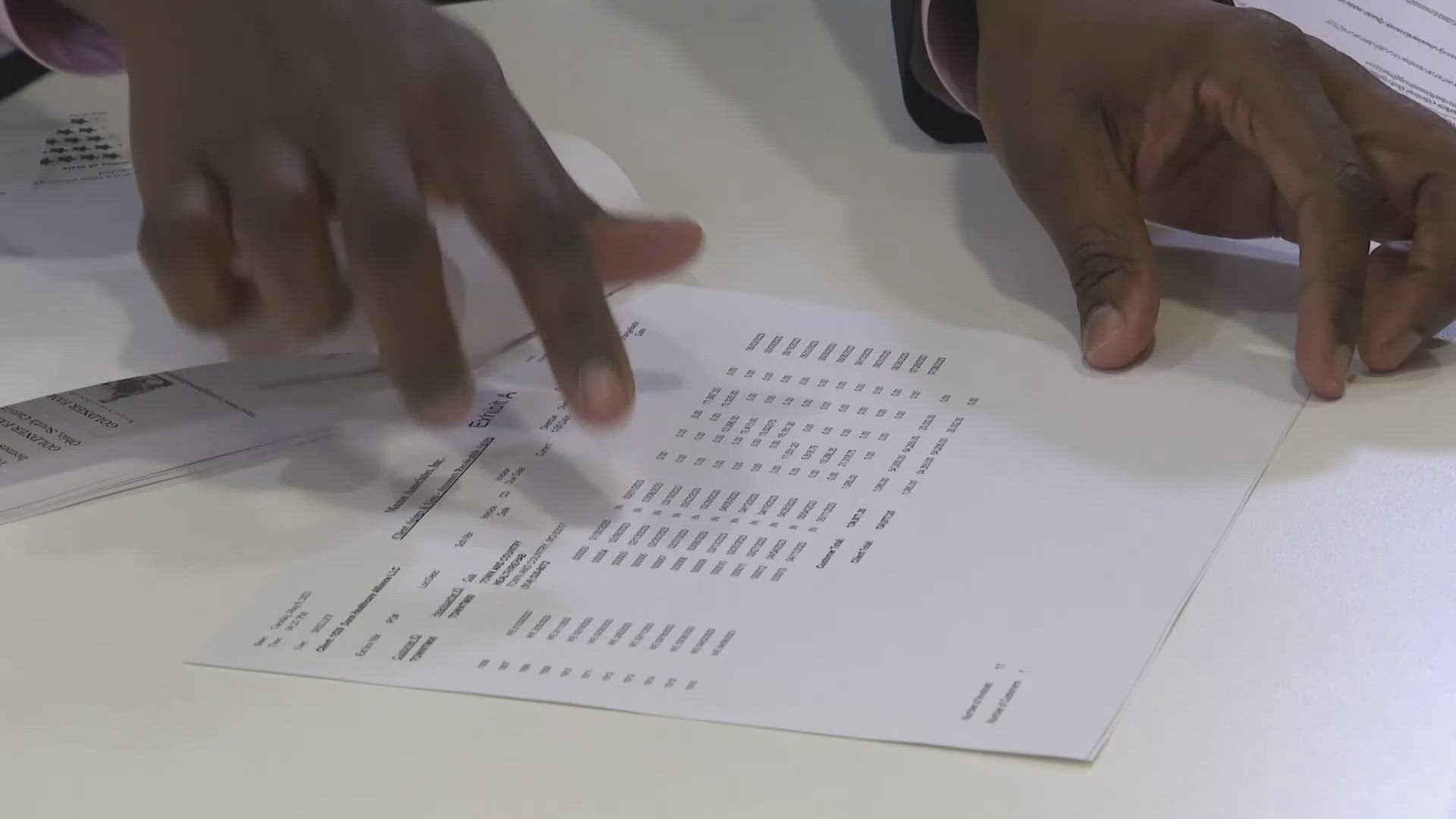

ST. LOUIS — Goldner Capital Management, led by Sam Goldner, has filed for Chapter 11 bankruptcy. Documents show the company owes around $50 million, including debts to Missouri nursing home vendors. But what does this mean for those hoping to get paid?

Chapter 11 could allow Goldner to restructure but unsecured creditors, like many of their vendors, are often last to be paid.

Impacted businesses tell us it’s left them in financial ruin and nursing home residents without essential equipment, like beds and ventilators, according to Zach Lutz, a senior researcher and policy analyst at St. Louis-based SEIU HCII, a union of healthcare, child care, home care and nursing home workers.

Critics argue this latest bankruptcy filing reflects the issue of private equity firms in health care, especially when the goal is about cutting costs and increasing profit, according to Sam Brooks, director of public policy at the nonprofit the National Consumer Voice for Quality Long-Term Care.

Filing for bankruptcy could help Goldner avoid paying creditors, at least for now. The state of Missouri said Goldner is no longer operating long-term care facilities in Missouri, but the state still lacks authority to prevent companies with poor track records from entering the market.

A spokesperson with the Missouri Department of Health and Senior Services said Goldner has not attempted to purchase additional properties. He hasn’t been an operator in Missouri since last November.

The I-Team reached out to Sam Goldner’s attorney, who said they have no comment about the bankruptcy case.

Lutz said a bankruptcy filing may make it less likely that vendors will be paid the money they are owed. Creditors cannot collect on a debt while a Chapter 11 case is pending and while the debtor develops a plan of reorganization. The process typically takes 6-12 months. Even then, there is no guarantee that the creditors will recover some or all of what they are owed via the plan or reorganization as the process is complex and unpredictable. Lutz said the filing will allow Goldner to escape his creditors at least in the short term and possibly altogether.

Previous coverage: