ST. LOUIS — There's a growing financial crisis in the St. Louis Public Schools’ pension fund that could impact the future of education.

Industry insiders described a ticking time bomb at the heart of St. Louis Public Schools — a pension system that’s rapidly running out of time, and money.

The I-Team has uncovered concerning issues that put both the district and its teachers on shaky ground, raising concerns about the future of its financial promises.

“You start to feel the pinch of that pretty quickly," said Byron Clemens, a spokesperson with the American Federation of Teachers in St. Louis. He's also a retired high school teacher.

As the head of the largest teachers union in St. Louis, he said he talks to retirees every day who are struggling.

“The much older retirees, it's a real issue for them to make their ends meet," he said.

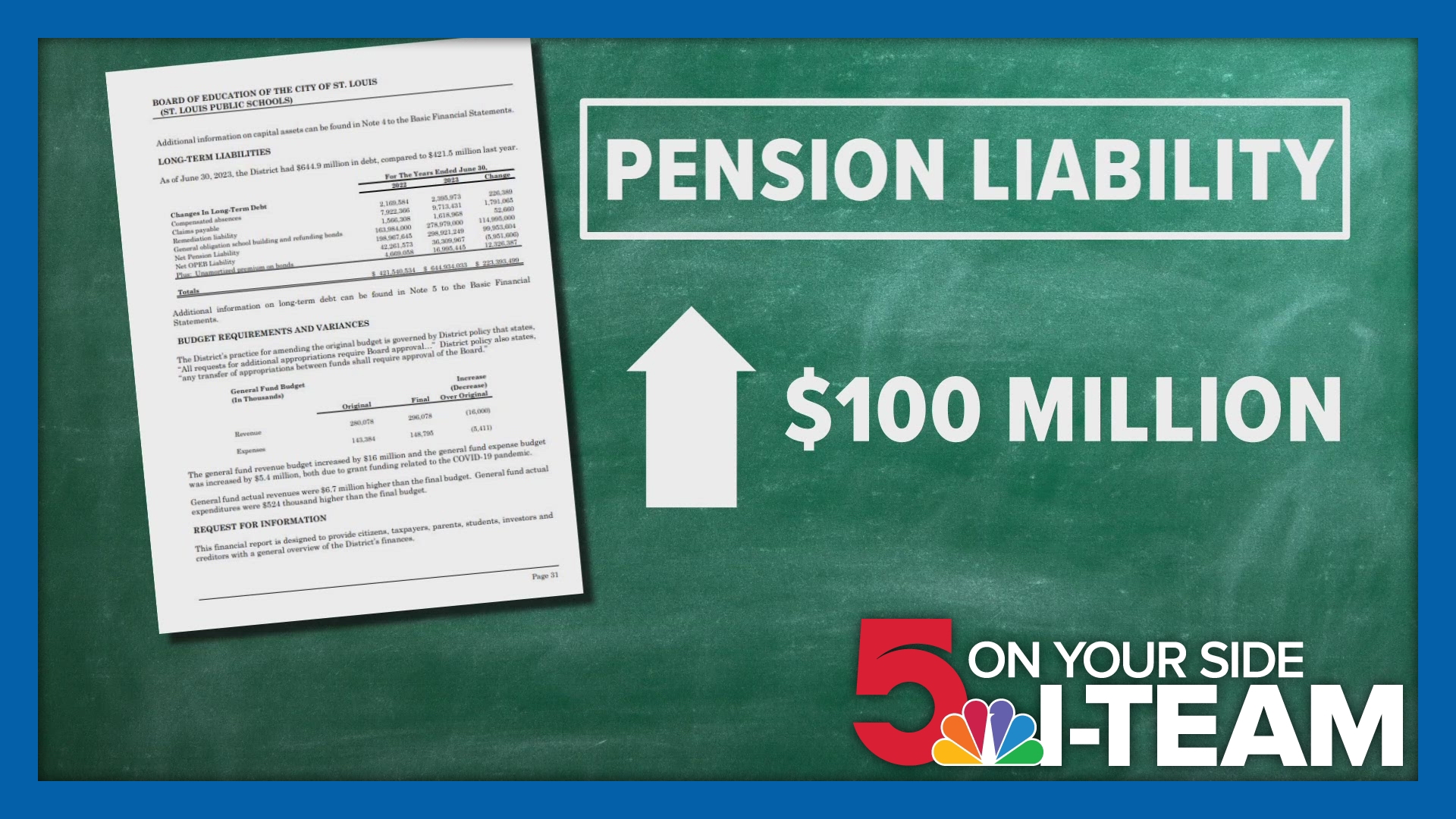

The St. Louis Public Schools pension fund — intended to provide a secure future for the district’s retired employees — has seen worsening financial health in recent years. Its most recent financial report shows the district’s pension liability has exploded, increasing by nearly $100 million last year alone.

Industry experts pointed to a 2017 bill that slashed the contributions St. Louis Public Schools had to pay into the system, all while increasing the benefits promised to retirees.

“It's heartbreaking," said Missouri Rep. Doug Clemens (D - 72nd District).

Rep. Clemens is Byron’s brother on the state’s pension committee. He said as more teachers retire, they’re pulling from a system that’s bleeding money, while fewer new teachers are coming in to replenish the fund. SLPS now has thousands of retired members drawing from a system that can not afford cost-of-living adjustments amid surging inflation.

“Basically, we're not going to have enough money to give people what they paid into their retirement," he said.

One SLPS insider told us the district is "walking on eggshells." In 2023, the SLPS pension system was placed on a public watch list due to its dangerously low funding ratio. Lawmaker Clemens told us the district is not contributing the "actuarially required amount" — the amount promised to teachers and staff to keep the system afloat.

The public watch list is a list of Missouri-based public pension funds under state statute below a certain funding level.

Earlier this year Doug Clemens filed House Bill 2846 to stabilize the pension fund by freezing contribution decreases as a first step. But so far, SLPS has resisted, arguing the reforms would limit flexibility and create more financial headaches.

“We had people come in and testify who literally are not having the money come in to feed themselves and keep their lights on," he said.

A spokesperson with the pension fund told us they’re talking with St. Louis Public Schools and others right now to figure out a solution.

A spokesperson with the Public School Retirement System of the City of St. Louis told us:

“The Public School Retirement System of the City of St. Louis (PSRSSTL) provides pension benefits to eligible employees in the St. Louis Public School district and Charter Schools located in the City of St. Louis. The System is funded by employer and member contributions. The legislation passed by the MO State Legislature and signed into law in 2017 has made it challenging for the System to improve its long-term funding ratio.

PSRSSTL is paying all benefits due to the 4,201 retired members and their survivors. Active Membership, which decreased to 4,594 members in 2022 as a result of the pandemic, has gradually increased and is now back to 5,000 members as of the January 1, 2024 Valuation. The System is currently engaged in discussions with stakeholders, including St. Louis Public Schools, on employer contributions. PSRSSTL is confident that these discussions will lead to a solution acceptable to all stakeholders that will serve as the foundation of new legislation to improve contributions to the Retirement System.”

The I-Team out to St. Louis Public Schools for comment and is waiting to hear back.

A person at City Hall familiar with the issue told us in an email:

"Right now everyone has questions about district finances. Pension underfunding on this scale is deeply concerning and raises many more. What's the district's plan to shore up pensions? Does it have one? The pension system seems to."