ST. LOUIS — St. Louis breweries and distilleries got an extra Christmas gift under their trees this year. A provision of the recently passed federal stimulus package is poised to save local breweries and distilleries thousands of dollars annually in tax costs.

The bill, signed by President Donald Trump last week, included the permanent adoption of the Craft Beverage Modernization and Tax Reform Act (CBMTRA), a hard-fought federal excise tax relief measure for small brewers, distilleries and winemakers.

Small domestic breweries — those producing fewer than 2 million barrels annually — were previously required to pay $7 per barrel on the first 60,000 barrel produced each year. The Brewers Association, the industry's national trade group, has been pushing since 2009 to reduce that tax rate, and got its wish in 2017, when Congress cut the rate to $3.50 per barrel.

But that measure was only temporary and set to expire on Dec. 31 unless Congress either extended or made them permanent. Its inclusion in the federal relief bill will not only save brewers money, but provide them a degree of cost certainty they didn't have before.

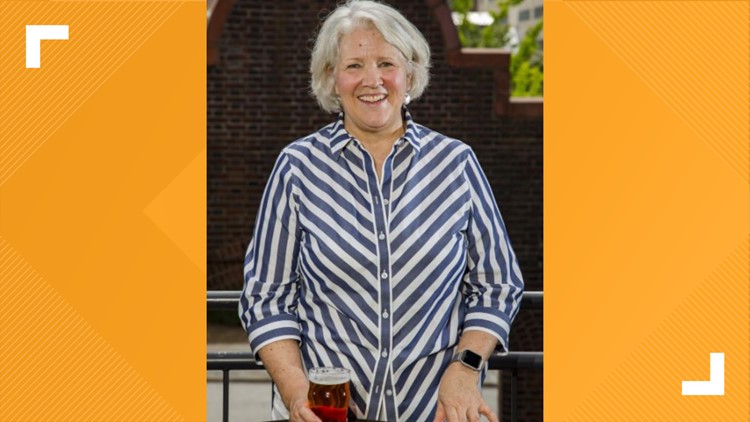

The Saint Louis Brewery, maker of Schlafly Beer, estimates it will save about $105,000 annually as a result of the permanent $3.50 tax rate, said CEO Fran Caradonna. Schlafly is St. Louis’ largest craft brewery with 31,000 beer barrels produced in 2019.

“I know for Schlafly, and I’m fairly certain for our fellow craft brewers, that money gets invested back into the brewers in the form of expansion, new employees, that kind of thing. I can’t tell you how pleased we are to see it be something we don’t have to continue to worry over at the end of every year,” Caradonna said.

Click here for the full story.