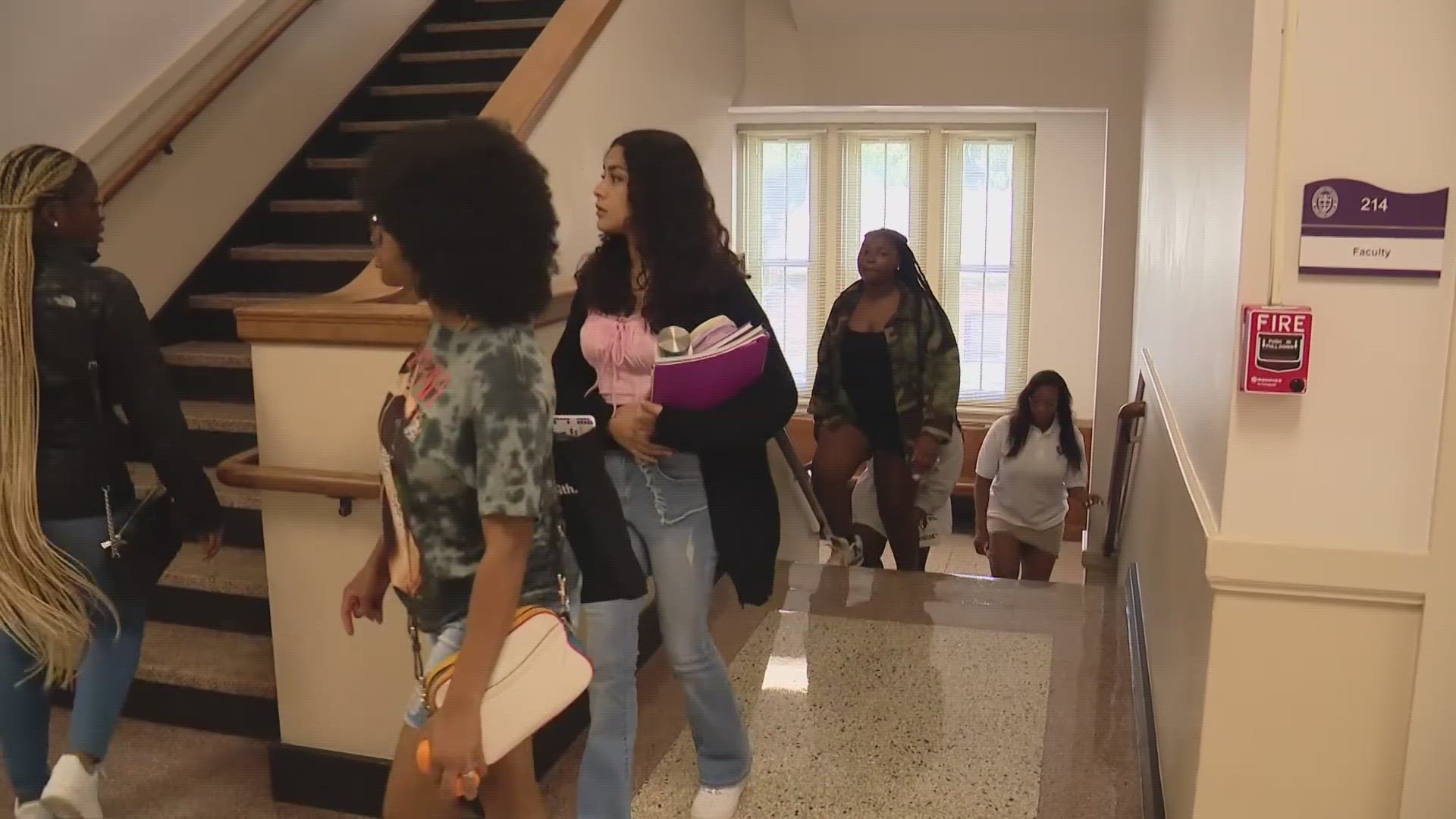

ILLINOIS, USA — Illinois' Tax Holiday started Friday for clothing, footwear and school supplies.

The deal lasts for two weekends, running from Aug. 5 through Aug. 14. The Illinois Tax Holiday is a bit different than Missouri's Tax-Free Weekend that just concluded.

In Illinois, the state tax is lowered by a flat 5% on qualifying clothing and school-related items.

For a list of qualifying and non-qualifying items during Illinois' sales tax holiday, click here.

If the total sales tax rate is 10%, the rate for this holiday is 5%. Clothing and footwear must be less than $125 to qualify. There is no dollar limit on school supplies, but they must be used in the course of study.

Items that are eligible for the deal include normal schoolwear, warm weather gear and uniforms. Cosmetics, wigs and jewelry are not included.

School supplies that are eligible include book bags, notebooks, and writing and drawing supplies. Ineligible school supplies include sports gear, paint supplies, computers or other electronics.