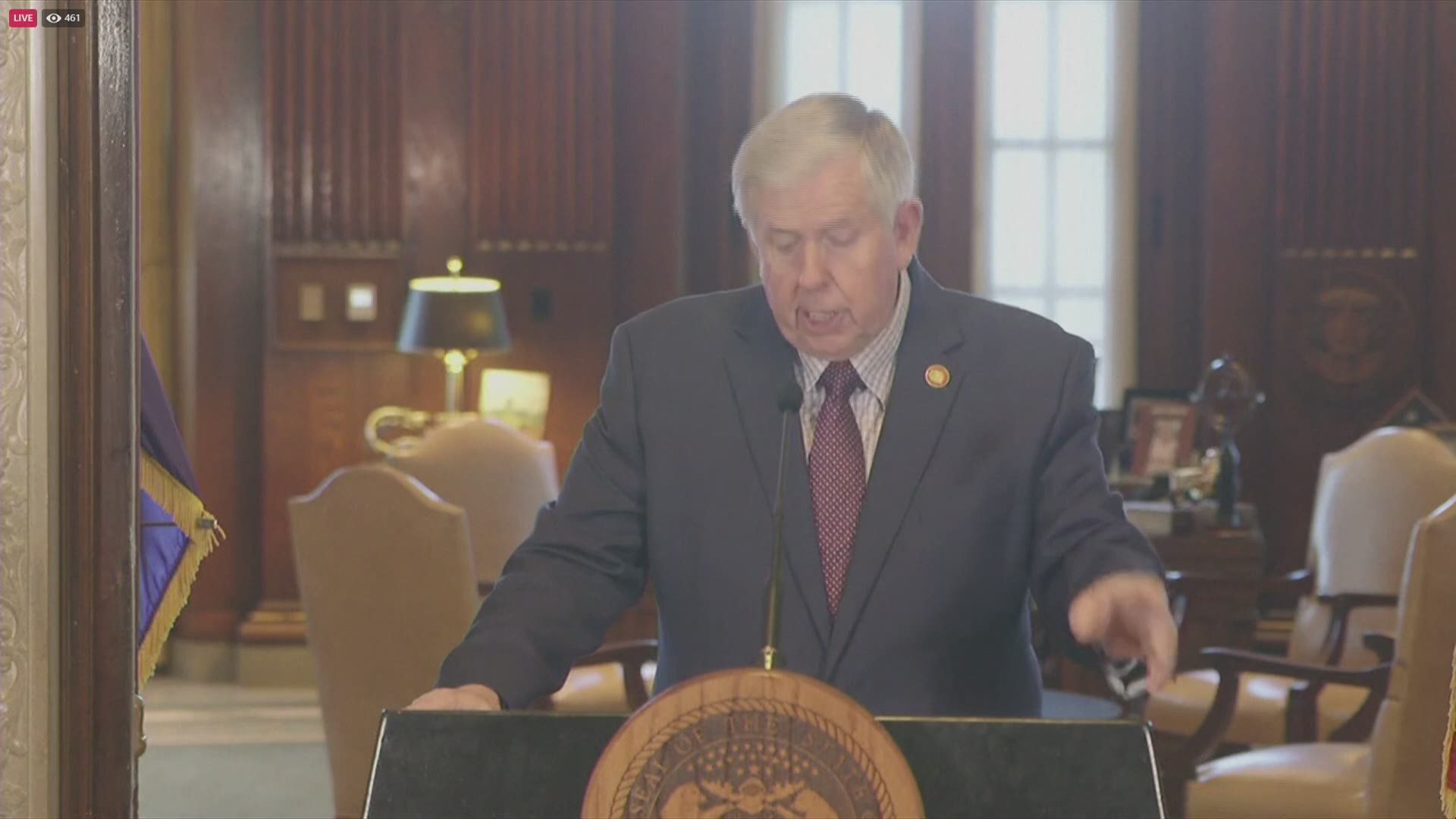

JEFFERSON CITY, Mo. — Missouri Gov. Mike Parson on Thursday said businesses forced to temporarily shut down because of local COVID-19 mandates should get tax breaks.

Parson told Missouri Press Association members and reporters that restaurants and other businesses shouldn’t have to pay property taxes for times when they were ordered closed because of the pandemic.

He said restaurants in particular were “punished beyond any other business” and that tax credits are one option to be considered in order to compensate businesses for financial harm caused by forced closures.

“I can't imagine me trying to pay for my family and for my kids living and government coming in some day and saying you can't put your key in your own business and you can't open up and make a living for your family,” Parson said.

A Senate committee last week debated a bill that would offer tax credits to make up for property taxes owed for periods when businesses are forced to close. The measure hasn't been voted out of committee yet.

St. Louis County, a frequent COVID-19 hotspot, has implemented some of the strictest business restrictions in the state in an attempt to slow the virus' spread, including at times shutting down in-person bar and restaurant services for weeks.