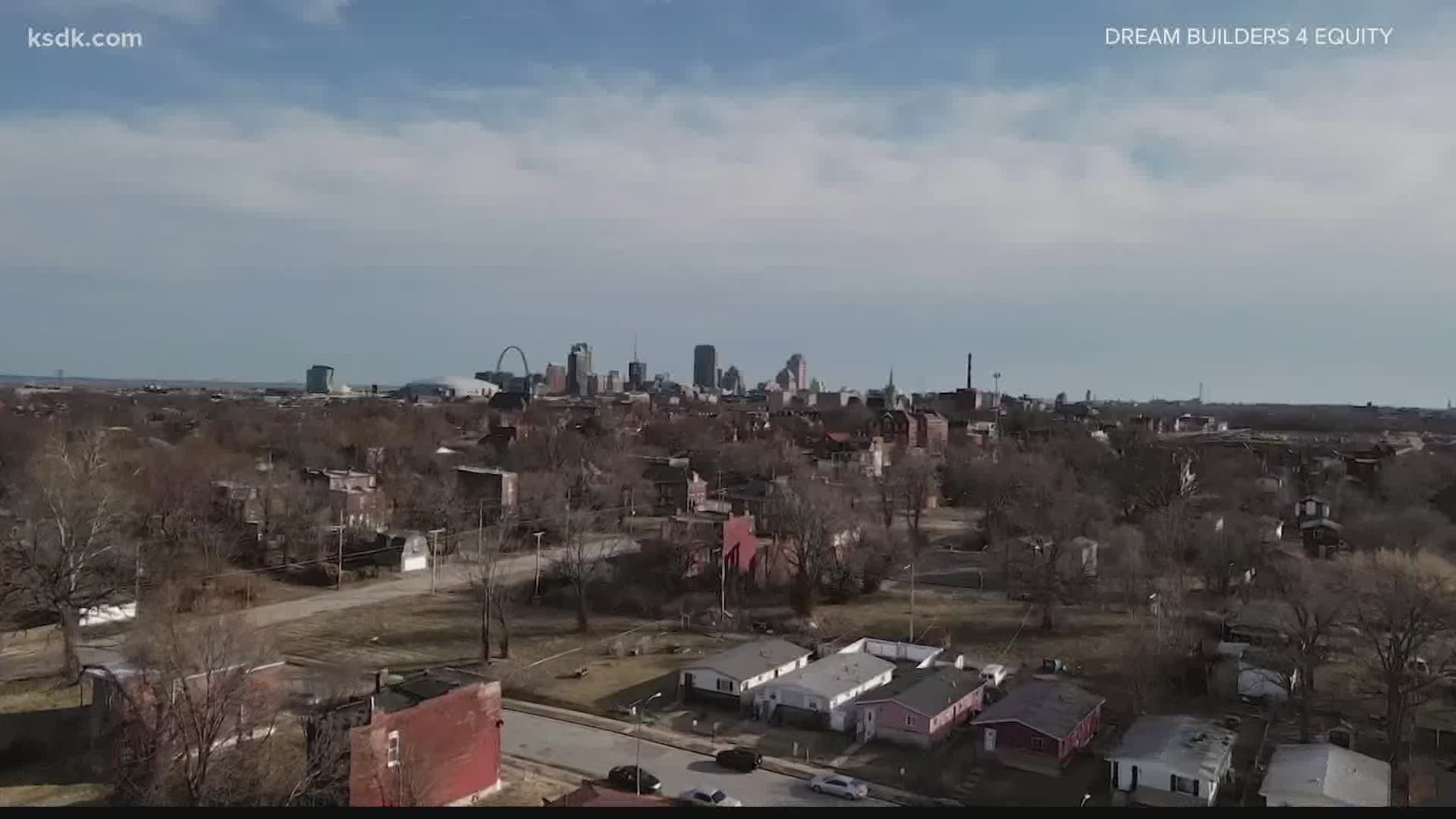

SAINT LOUIS, Mo. — Michael Woods grew up in Hyde Park in St. Louis, and though he's spent the last few years trying to make a change for the better, he knows change takes time.

"These communities have been lacking investments for years," said Woods.

St. Louis is a tale of at least 70 ZIP codes, according to Clever Real Estate, a real estate company based in University City. Its data scientists looked at roughly 30,000 ZIP codes across the country and found major disparities between neighborhoods that are predominantly Black and predominantly white.

"The disparity between the white and Black ZIP codes is larger in some areas, particularly in the Midwest and the South," said Francesca Ortegren, data scientist with Clever Real Estate.

She said the study was a massive, data-rich project that shows St. Louis as one of the worst when it comes to housing inequities. It's a problem that likely stems from decades-old housing discrimination from the Jim Crow era.

"The majority-Black neighborhoods have seen a decrease of nearly $50,000 in their home values since 2004," said Ortegren. "That's compared to about a $22,000 increase in white neighborhoods or white ZIP codes in the St. Louis area."

That means if you're a homeowner in a Black neighborhood, chances are, you're losing money.

Clever Real Estate also found that homes in predominantly white ZIP codes command about $193 per square foot, compared to around $115 per square foot in predominantly Black ZIP codes. This means a 2,000-square-foot home would price at $386,080 in a white ZIP code but only $299,900 in a Black one.

"It's not just because those homes were bigger or newer," said Ortegren on the reasons why white neighborhoods fare better. "It's also because they're just selling for more per square foot. So there's kind of a value to the whiter neighborhoods, unfortunately."

Ortegren said this study just looked at Black and white neighborhoods, but Hispanic neighborhoods tend to fare worse than Black neighborhoods in terms of finances and economics. There was not enough data on Asian neighborhoods.

"A Black household has about a tenth of the wealth that a white household would have," said Woods, the cofounder of the nonprofit Dream Builders 4 Equity. "That is a huge problem that is also creating this wealth gap."

The nonprofit is now working with Clever Real Estate to educate the community on the issue and to turn around this very old problem. The goal is to help a community find wealth through homeownership and revitalization as well as serve youth in underserved neighborhoods.

In the summer youth program, students learn about real estate, rehabbing properties and selling them — Dream Builders even gives young people a share in the profits.

"I wrote down everything and soaked it in like a sponge," said 16-year-old Davion Sides. He and his twin brother, David, have big dreams of getting into real estate during high school. Architecture, STEM and design are also in their future.

"We learn things that get us ready for life," said Davion.

Data shows revitalizing a challenged neighborhood leads to an overall healthier economy. It's about investing in our city, no matter the address. Dream Builders says every 10% increase in the total housing market wealth translates to $147 billion in additional consumer spending.

"It's working every single day — it's growing," said Woods. "What we're hoping is that we create a model that can then be replicated."