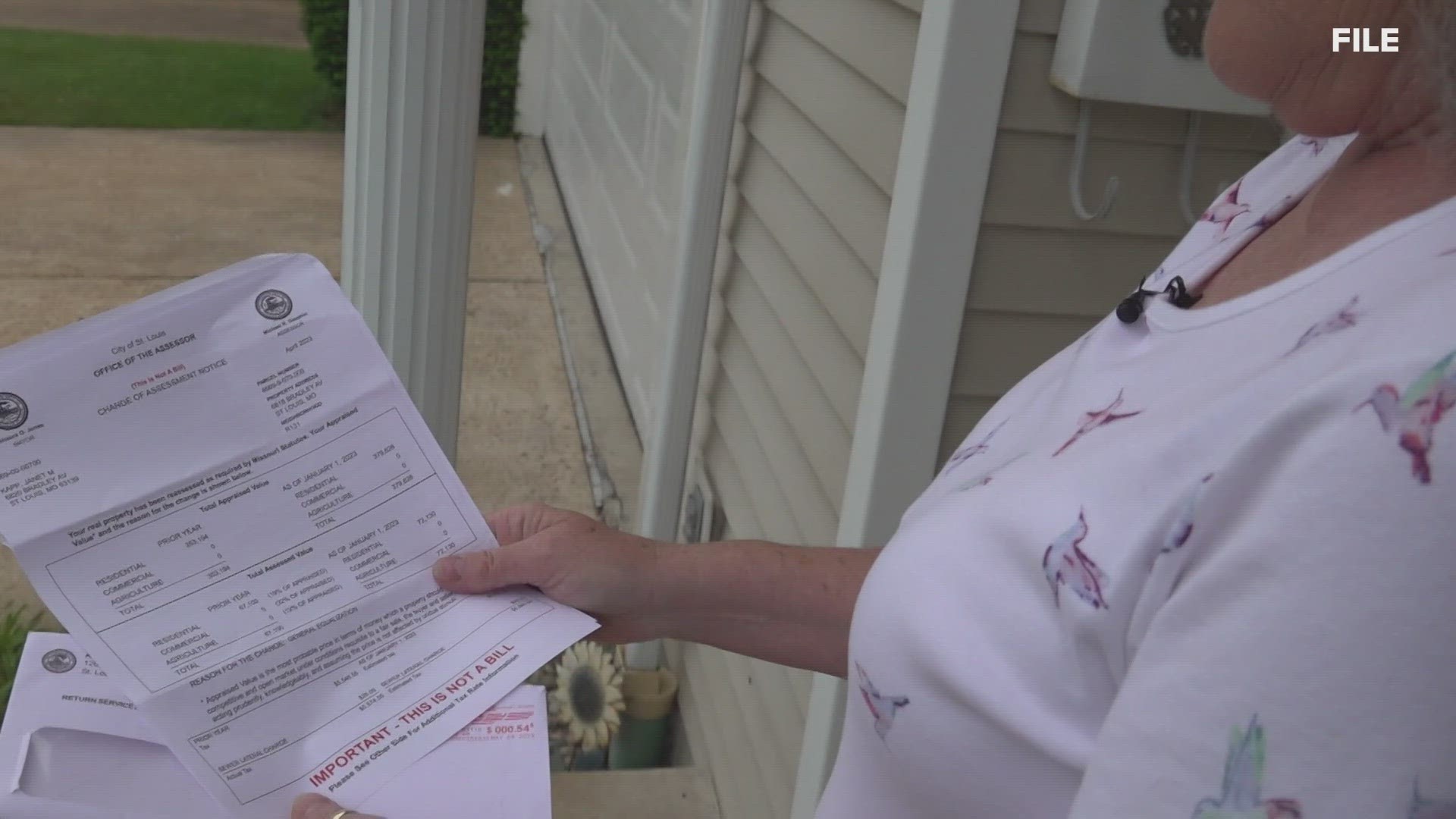

ST. LOUIS — Some seniors in the City of St. Louis may soon get tax relief through a property tax freeze if they qualify for the county's new program.

The city announced Monday that applications for the county's senior property tax freeze are now open. The freeze comes after Missouri Gov. Mike Parson passed a law in 2023 that allowed counties to enact the property freeze.

PREVIOUS COVERAGE: Missouri lawmakers pass tax breaks for seniors

How to apply for St. Louis City's senior property tax freeze:

A digital application can be filled out on the city's website. Those interested in applying must validate their address and have the option of uploading all necessary documents online. If the applicant chooses not to upload the documents digitally, they are responsible from bringing them to the assessor’s office by June 30.

Applicants can also download a paper application, fill it out, and send it to the city's assessor's office at 1200 Market St., Room 120.

Eligible applicants must be at least 62 years old, reside in the City of St. Louis and have at least 40 Social Security credits. They must also be the owner of a property valued under $500,000 and be liable for taxes on that property.

“This property tax freeze is meant to protect senior St. Louis residents from being displaced due to rising property values as a result of community and economic development,” said St. Louis Mayor Tishaura Jones. “I encourage qualifying seniors to apply so they can take part in the economic development of our city without the risk of being priced out of their homes.”

St. Charles County made a similar announcement Monday.

Top St. Louis headlines

Get the latest news and details throughout the St. Louis area from 5 On Your Side broadcasts here.