ST. LOUIS — Thousands of people could soon be eligible for a refund, after the city of St. Louis recently settled a lawsuit over its earnings tax.

Residents who live in the city of St. Louis pay a 1% earnings tax. People who live outside of the city, but whose employer is based in St. Louis, also pay the tax.

Six remote workers, along with attorneys Mark Milton and Bevis Shock, filed a lawsuit for being taxed while doing work remotely, outside of the city limits, during the pandemic.

A three-year battle and a settlement resulted in a refund process, which will begin July 1.

Collector of Revenue Gregory F.X. Daly said the city has set aside $26 million for the refunds.

Daly shared this statement on June 14 about the settlement:

“My office, along with the city, chose to fight this lawsuit because we believed our actions were consistent with the terms of the statute and the right thing to do on behalf of the people of the City of St. Louis,” said Gregory F.X. Daly, Collector of Revenue. "While the Courts affirmed the majority of the collector’s and city’s positions, it determined that remote work for non-city residents would not be subjected to earnings and payroll taxes in the manner in which the city and the collector interpreted the statute.

Daly explained, “We respect the Court’s decision and have put in place a simple process compliant with the Court’s order. Our goal is to provide a transparent and easy-to-understand process for people to make first-time refund applications for remote work for the years 2020, 2021 and 2022."

Who can apply?

- This applies if you live outside city limits

- Worked remotely in the years 2020, 2021, 2022, and 2023

- Have a city employer

- You can apply yourself or hire a tax professional

If this applies, there are several items needed:

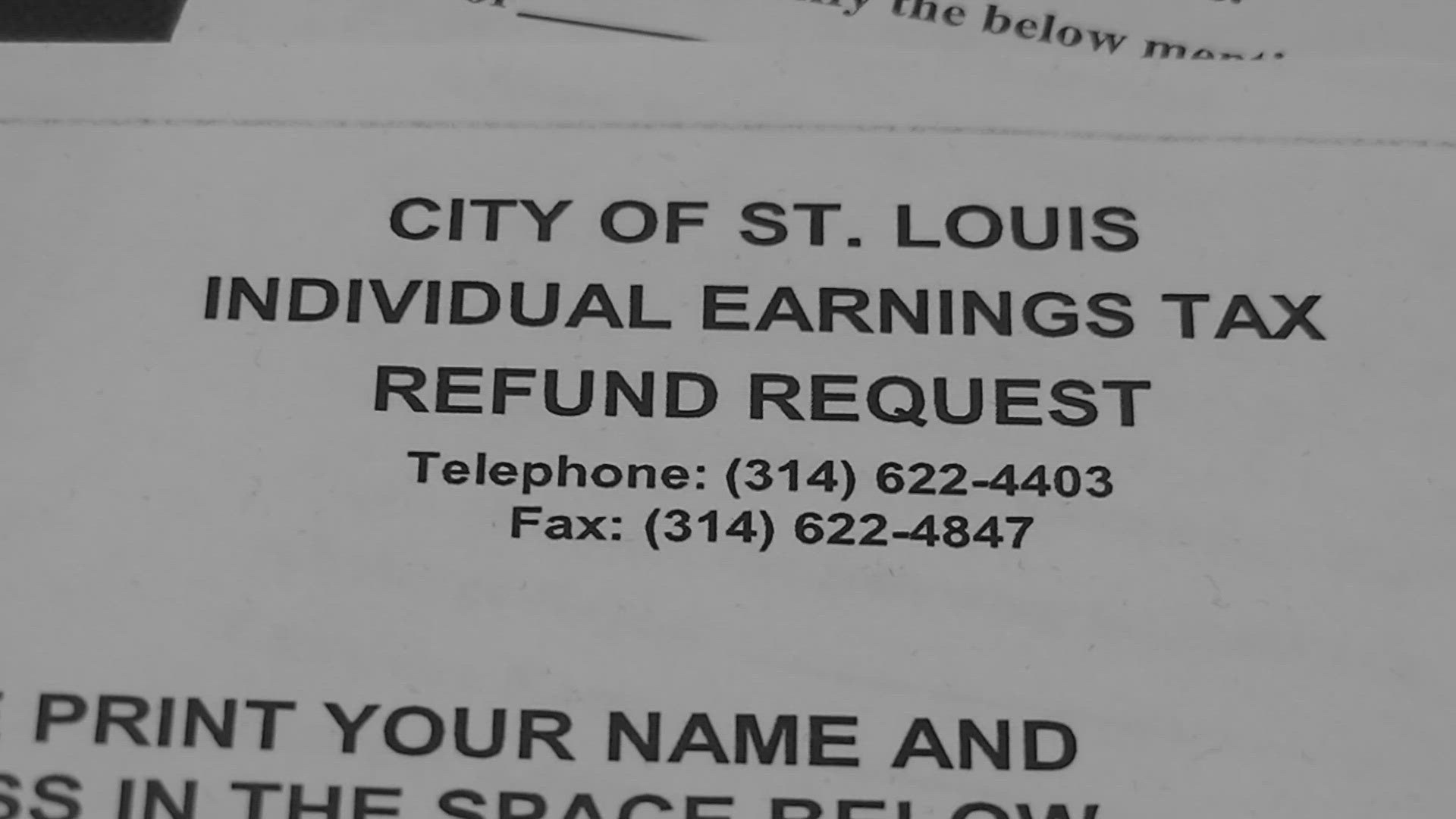

- The E-1R form for each tax year; the form can be found on the Collector of Revenue's website here

- A W-2 form is also needed for each year

- An applicant will need to provide the number of remote days

- The number of days worked out of the city must be verified by the employer

Milton said having some documentation showcasing remote days helps to hand over.

He added, "Some people have fob records to see how many times they went in the door."

Milton believes 100,000 people are affected. He added that even if you worked one day remotely, you can still apply.

Daly said in a news release, to date, approximately 2,100 taxpayers have filed appeals for their remote earnings for the years 2020-2022. Those appeals will be honored and those taxpayers do not need to refile them.

"It does not come out automatically. This is on you as a taxpayer to either do it yourself or hire a taxpayer professional," Milton added. "This is a tight window you have to be proactive with it. Don’t wait. You’re going to need time for the number of days, to find your W-2 and give your employer sufficient of time."

Once refund applications are verified and calculated, refunds will be processed in the order they are received.

Payments should be completed by the end of 2024.

Deadline:

- For tax years 2020, 2021, and 2022, claims must be submitted by Sept. 30, 2024

- For 2023, the deadline is April 15, 2025