ST. LOUIS — President Biden announced student loan debt forgiveness and it spurred split opinions on Friday.

Opinions on eliminating debt have been split for several years, recently when it was excluded from Biden’s $1 trillion infrastructure bill and lawmakers weighing out the pros and cons and how much borrowers should receive.

On one end, there are those happy to have a weight lifted off of their shoulders, while others argue that forgiveness is pivotal in addressing racial disparities in the economy but question whether it’s an adequate amount.

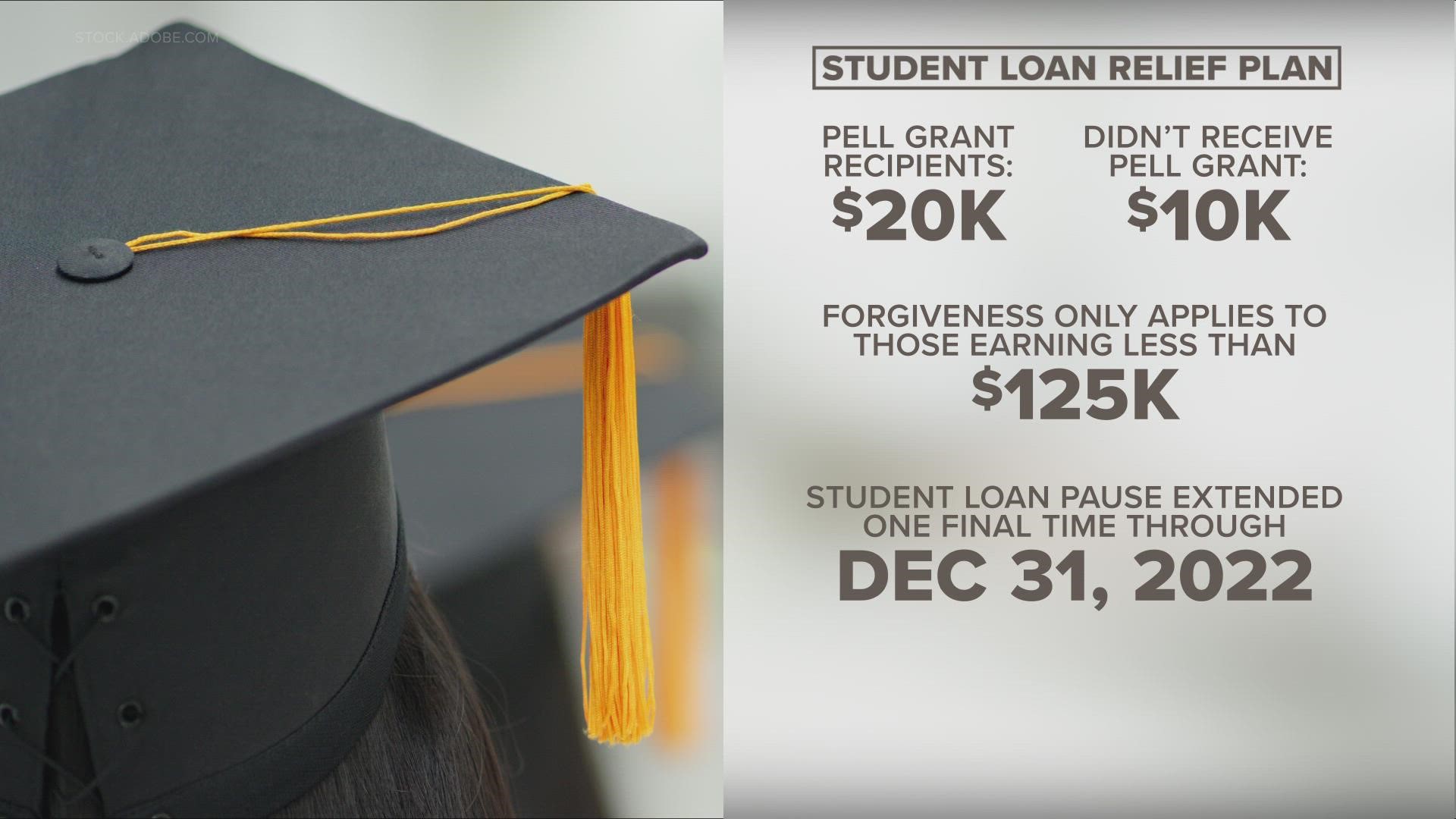

Under the new plan, if a person earns less than $125,000 a year, they can receive $10,000 in forgiveness.

Those who went to college on Pell Grants under that income threshold qualify for $20,000 dollars in forgiveness.

That is the reality for 34% of students at Webster University.

Beth Stroble, the school's chancellor, told 5 On Your Side it would benefit groups the institution has fought to make sure receive an equitable education for many years and restore students and their families financial futures.

“That debt can be the difference between being able to reinvest in the kinds of things that make it possible to make a job move, or to make a housing investment, or to invest in your own children’s education,” Stroble said.

St. Louis City NAACP President Adolphus Pruitt wondered if the amount would be sufficient.

Particularly African Americans who have on average more than $53,000 in student loan debt.

Pruitt also stated that the group has not been able to buy homes or get credit due to student loans weighing down their credit scores.

“Why it's helpful to those who have small loans, for those who have significant student loans or graduate loans, it really doesn't help give them the help they really need," Pruitt said.

There is mixed reaction over the President's plan to forgive some student loans. While millions or borrowers are excited, others are concerned the cost will be passed on to every taxpayer. Dr. Max Gillman from UMSL sees both sides of the equation including those who are breathing a sigh of relief, as well as those who feel that already tough times will get tougher for everyone.

There are concerns from those who won't qualify for the loan forgiveness.

"They will feel like they're being unfairly treated,” Gillman said.

While he understands the praise for the plan, he also believes wiping out all of those student loans will deepen the nation's deficit. "When you increase that deficit, the government has to raise taxes somehow. One way is income taxes. The other way is the inflation tax."

Does that mean the cost will be passed on to you?

"The general tax payer, who maybe they don’t have any kids and they don't care about students, they're not going to like having higher inflation,” Gillman added.

There's even mixed reaction coming in from lawmakers.

“Joe Biden is at it again, abusing his power to put working people on the hook for billions in college debt. It's unfair to million who played by the rules,” Sen. Josh Hawley said.

"Education is a human right but for too long our student debt crisis has put it out of reach for millions,” Representative Corri Bush countered.

Gillman warns against current and future students borrowing more than may need to because they think *their* student loans could be forgiven in the future. There's no guarantee of that. He also cautions against a term known as Moral Hazard. That’s where a governmental policy causes those it’s supposed to help to actually go into jeopardy by, for example, taking on even more, perhaps unnecessary debt as a result.

The pause of student loan payments is also being extended through the end of December.

The president said during his press conference there will be a form released to apply for forgiveness by then as well.

To watch 5 On Your Side broadcasts or reports 24/7, 5 On Your Side is always streaming on 5+. Download for free on Roku or Amazon Fire TV.