JEFFERSON CITY, Mo. — Missouri senators on Tuesday passed $40 million in annual tax breaks for farmers, ranchers and other agriculture-related businesses as part of a special legislative session.

Senators voted 26-3 in favor of the tax incentive package, which primarily renewed tax credits that had expired. The measure includes tax credits to benefit companies involved in meat processing, biodiesel, ethanol fuel and urban farms. It also expands government loan programs for farmers.

“The bill that we passed is a big win for rural Missouri," Republican Senate President Pro Tem Dave Schatz told reporters Tuesday.

Republican Sen. Mike Moon, a cattle rancher, during Tuesday debate raised concerns about foreign-owned Missouri farm companies benefitting from the tax breaks. Moon voted against the bill.

“We want to protect Missouri farmland for our families who come after us,” Moon said, adding that he wants “to make sure it stays in the hands of Missourians.”

Republican state Sen. Jason Bean, a farmer who ushered the agricultural tax credits through the Senate, said he expects lawmakers to debate foreign ownership of Missouri farms during the next legislative session, which begins in January.

The Republican-led Missouri Legislature passed a bill with similar agricultural tax credits during the regular legislative session, which ended in May.

GOP Gov. Mike Parson vetoed the measure, citing a two-year sunset attached to many of the tax credits that he said was too short. He called lawmakers back for a special session to extend agricultural tax breaks for another six years, as well as spend some of the state’s revenue surplus on an income tax cut for individuals.

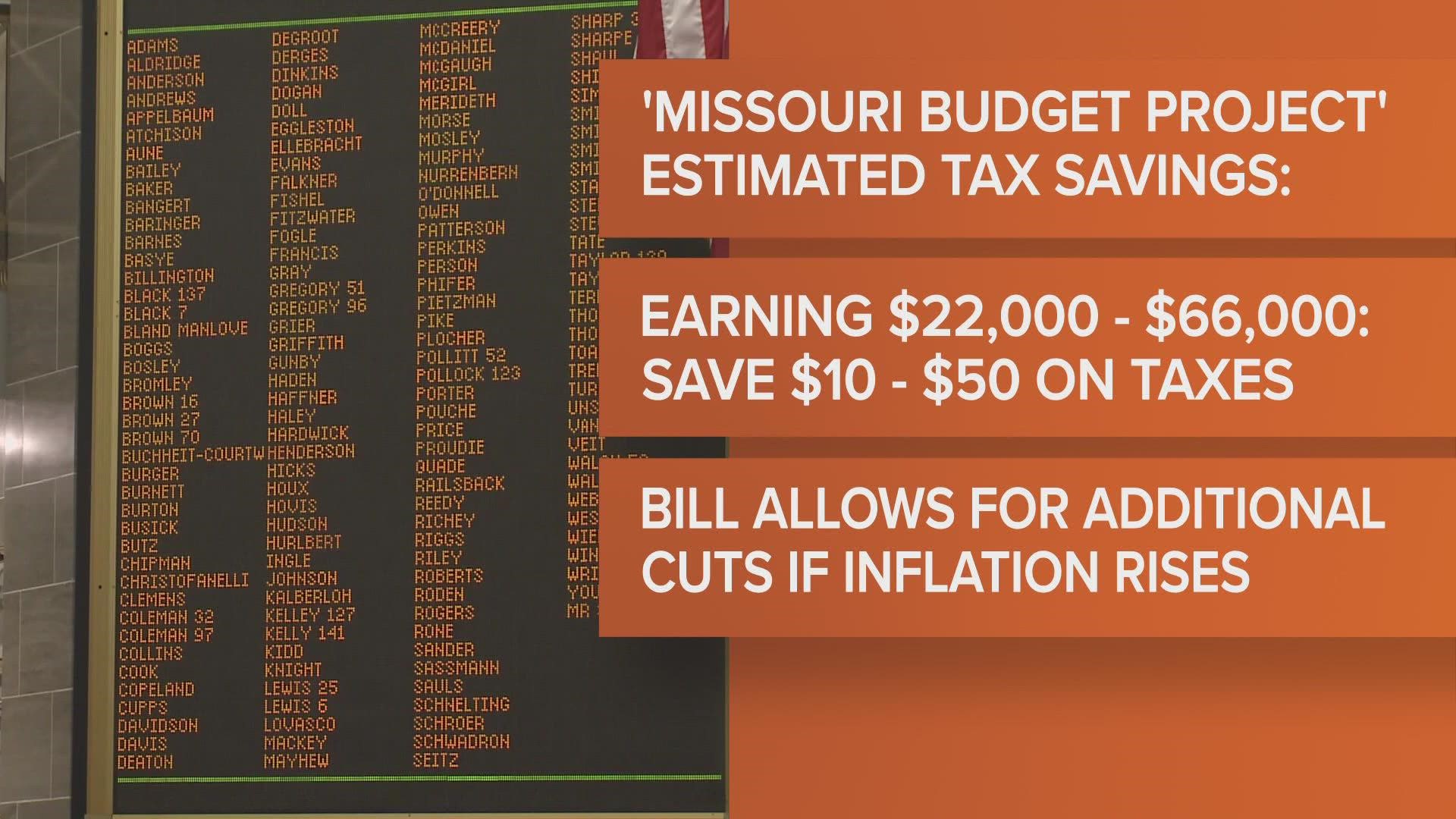

The House last week sent Parson a bill to cut individual income taxes from 5.3% to 4.95% beginning next year and phase in additional cuts until the rate hits 4.5%.

The Senate's passage of the agricultural tax incentive bill caps off the rest of lawmakers' unfinished business for the special legislative session.

Parson has not indicated when he will sign the bills.