ST. LOUIS — President Joe Biden's plan to forgive federal student loan debt sparked instant debate in midterm contests across the country as candidates look to use the issue to their advantage.

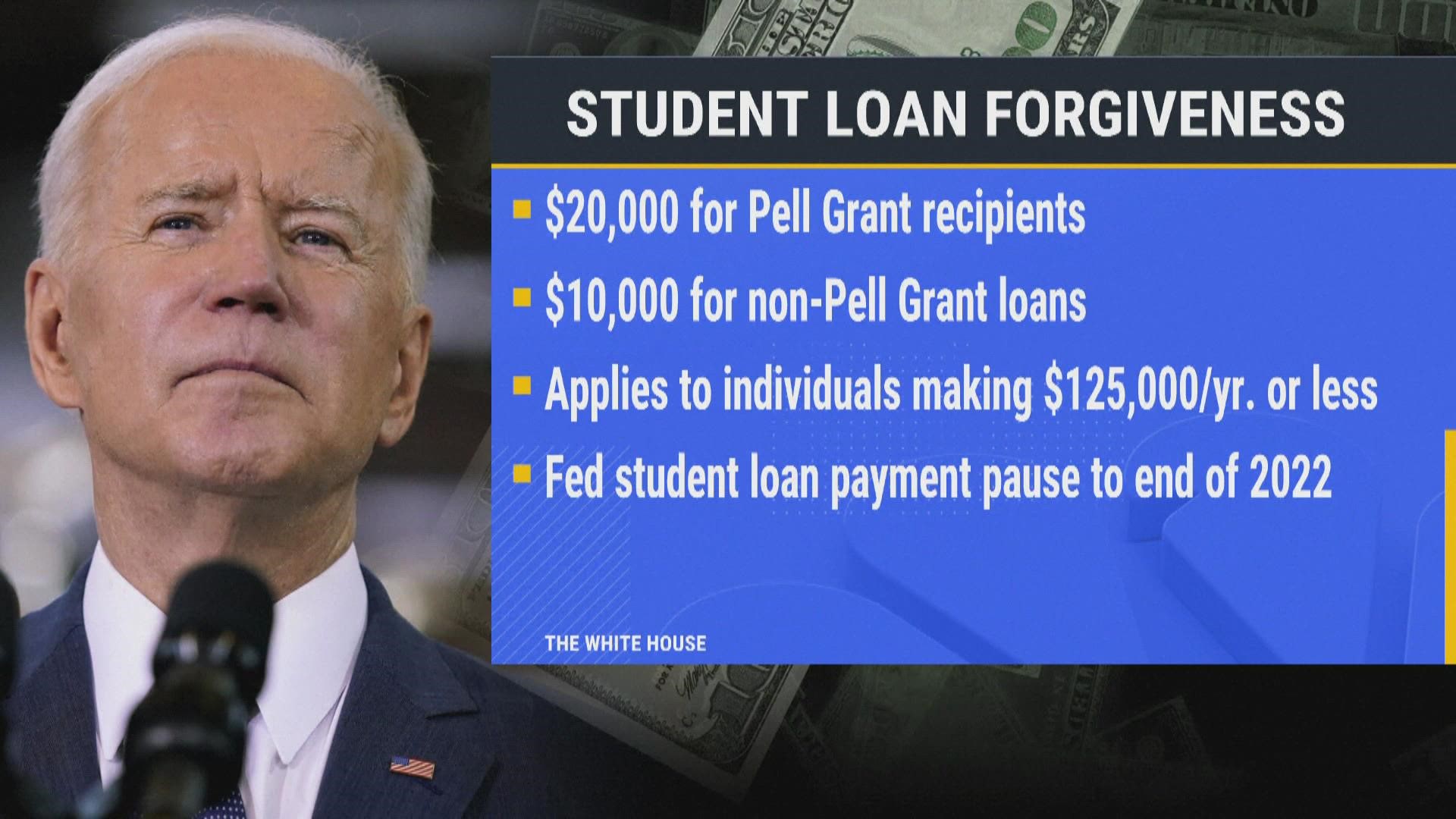

Biden's plan would forgive $20,000 in loan debt to people who received a Pell Grant and $10,000 for those with another type of federal student loan.

Democrats sold the plan as a way to provide debt relief from the sting of inflation, while Republicans smeared it as an abuse of executive power that will lead to further inflation, and suggested lower-income workers in labor-intensive service industries will bear the brunt of the cost to bail out white-collar college graduates.

That contrast was on display in Missouri's 2nd Congressional District where incumbent U.S. Rep. Ann Wagner, a Republican, faces a challenge from Missouri House Democrat Trish Gunby. The two women are competing in a suburban district home to a high concentration of college-educated voters.

"I think it's huge. I think it's a game changer," Gunby said about Biden's plan. "I think it gets people galvanized. They are looking ahead to their futures. It provides a path, and those who are certainly already encumbered by debt can kind of lose some of that and plan for the future."

"Anything you can do to help reduce debt, I think we can all agree is a good thing," she said.

"I think it's absolutely outrageous," Wagner said. "You've got literally millions of American taxpayers who are now footing the tuition bills, after not even going to college themselves, for Ivy League lawyers and surgeons."

Only people who make less than $125,000 per year would qualify under Biden's plan, which would disqualify most Ivy League lawyers and surgeons.

"I promise you the hard-working people of Missouri's 2nd Congressional District are not pleased about footing the tuition bill -- when they didn't even go to college -- of those that had that great privilege and honor; who took out a loan; who have a debt; and should be paying it back," Wagner said.

Biden's proposal delivers a massive gift to a core Democratic voter bloc of college-educated Americans. The White House has not released a price tag for the total cost to the U.S. Treasury, but economists have estimated the cost could be around $330 billion.

Missouri's Attorney General Eric Schmitt, the GOP nominee in the upcoming Senate race, framed Biden's student loan debt forgiveness as an "assault on working-class Americans."

In a series of tweets, Schmitt described student loan debt forgiveness as an unfair debt transfer from Harvard law grads to coal miners, or from tenured professors to waitresses, or in perhaps his biggest stretch, from Ivy League doctors to truck drivers.

According to a 2020 Medscape Physician Compensation Report, orthopedic surgeons were the highest-paid group of doctors and earned average salaries of $511,000, while pediatricians were the lowest-paid group of doctors and earned average salaries of $232,000. Doctors often earn much lower wages during the internship and residency stages of their careers right after medical school, and could potentially qualify for some student loan relief under Biden's plan depending on their household income.

A 2019 report from the Missouri Department of Higher Education found 53.7% of residents have a college degree or certificate.

Trudy Busch Valentine, the Democratic nominee running against Schmitt in the Senate race this fall, has not responded to any questions about the student loan debt forgiveness, a sign her campaign may not see Biden's proposal as a winning issue in a statewide race.

Wagner argued it was Democratic policies, not Republican rhetoric, that were pitting income classes against each other.

"I think this is playing class warfare," Wagner said. "This is just a redistribution of wealth. It's picking losers and winners."

"I don't want to see it as a wedge issue," Gunby said. "I think we want all of our citizens to succeed. For some people, college is not the preference or the way they want to go. Those individuals who choose to stay in trade jobs, we want them to succeed, just as we want for people who go to college. We all need to support one another."

A White House spokeswoman said President Biden understands "this is not going to please everybody," but that he's "trying to make sure we're giving families a little breathing room."

Wagner said she took on $7,500 in student loans to attend the University of Missouri in the 1980s. Would she have accepted forgiveness for her loans?

"No," she replied. "You know what? I would not. I think it's wrong, fundamentally wrong. And I think you're gonna see a huge backlash among everyone -- whether you're someone who didn't choose to get a college education and now you're paying for the tuition bills of kids that that got one, or whether you're someone like me who paid off my student loans. This infuriates me also."

Gunby pointed to other examples of federal funds going to big companies and argued workers are worthy of similar consideration.

"Well, we got rid of debt for corporations, PPP loans, those sorts of things. So we decided we were going to commit to companies and corporations, I think we need to commit to our people.

A statement from Schmitt's government spokesperson indicated he could potentially file a legal challenge.

“We’re actively looking into legal options to halt the Biden Administration’s abuse of power," Schmitt's spokesman Chris Nuelle said in an email.

"It is unconstitutional," Wagner said. "It's wrong. And I think he will be sued over it."

"People were looking for leadership from the Oval Office," Gunby said. "He campaigned on it. He won. This was part of his platform. And he's followed through."

If Biden satisfied one campaign promise in delivering student loan relief, he broke another promise to explain how he would pay for his proposals. To date, the White House has not said how it would pay for the plan.