ST. LOUIS, Missouri — Two months after President Joe Biden touted his revised student loan debt forgiveness plan on the campaign trail in the swing state of Wisconsin, his authority to implement the proposal came under judicial scrutiny in a federal courthouse in St. Louis.

Missouri Solicitor General Josh Divine said the new plan would bring significant economic and political implications.

"You don't have to be an economist to understand free money is appealing," Divine told the judge.

"No doubt, the SAVE Plan is quite generous to many borrowers," U.S. Department of Justice attorney Stephen Pezzi argued in response.

Pezzi defended the president's discretion to give borrowers a break based on their income, citing an "unbroken bipartisan interpretation" at the Department of Education stretching back to the Clinton administration.

Divine challenged the president's power to extend "at least $300 billion" in student loan debt relief to millions of Americans under existing federal law.

"The Secretary [of Education] asserts power to forgive every penny of every student loan," Divine said. "Congress didn't give this power."

"Why do the hard work of legislating if the Secretary [of Education] can just do it with the flick of a pen," Divine argued.

Lawyers with the Department of Justice said the president's plan was merely an "amendment" to existing law that allows the federal government to set repayment rates for borrowers at certain income levels.

Missouri was initially involved in a committee process to negotiate this new rule with the Department of Education before it withdrew from the process.

"The statue simply authorizes no forgiveness at all," Divine said, arguing the bulk of the benefit would come out of the pockets of teachers and farmers in order to benefit "Ivy League lawyers at fancy New York law firms."

Federal judge John Ross, an Obama appointee, quizzed Divine and Pezzi in alternating rounds.

"I am curious as to the timing," Judge Ross said, pressing Divine to answer what took so long to file suit against a rule that had been initially announced in February.

Pezzi suggested if the state of Missouri was truly suffering "irreparable harm," then they wouldn't have waited so long to sue.

"We're trying to do this as quickly as possible," Divine told reporters outside the courthouse. "So far, there's been close to $10 billion in accounts that they forgiven. And every single one of those, it's just a tragedy to the American people who have been promised something in a promise that the president can't keep."

Pezzi and Simon Jerome, another DOJ attorney, declined to comment to reporters after the hearing concluded.

Divine, who argued the case on behalf of Missouri Attorney General Andrew Bailey, said the Missouri Higher Education Loan Authority (MOHELA) would lose hundreds of millions of dollars in fees and interest from student loan borrowers if the president's plan was allowed to go into effect.

That same strategy worked to undermine Biden's first attempt to grant mass student loan debt relief. The U.S. Supreme Court struck that plan down after former Missouri Attorney General Eric Schmitt filed suit.

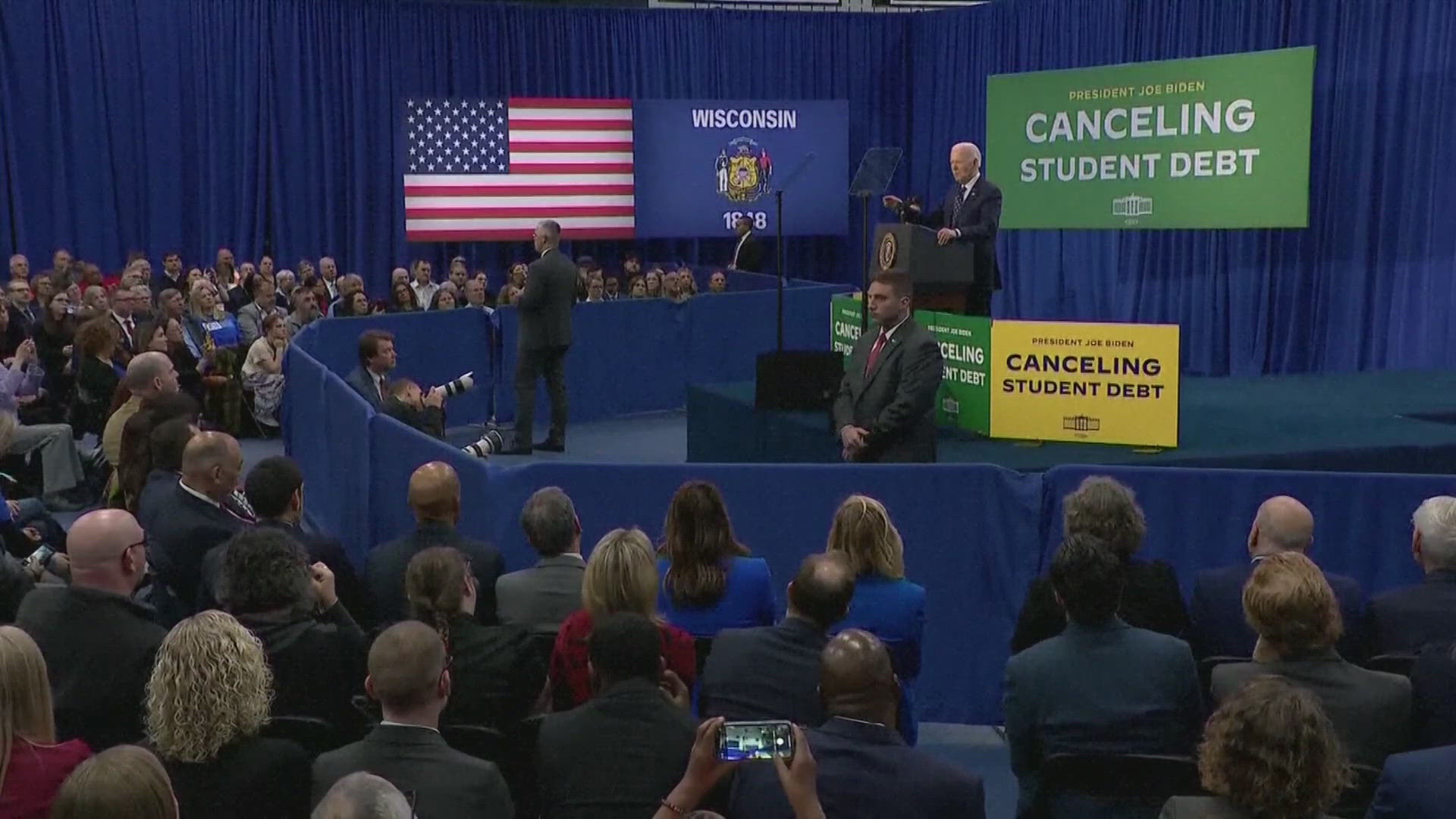

At his Wisconsin campaign event in the spring, Biden said he was undeterred.

"Tens of millions of people's debt was literally about to get canceled, but then some of my Republican friends and elected officials and special interests sued us, and the Supreme Court blocked us," Biden told the crowd. "But that didn't stop us. We continue to find alternatives passed to reduce student debt payments that are not challengeable."

Part of the president's plan essentially extends a benefit to workers in the private sector that many public sector employees already enjoy.

Divine called the president's new proposal his 'plan B,' and argued that it would harm the Attorney General's office and its attempts to hire and retain employees.

"We have the Public Service Loan Forgiveness Program," Divine said. "It's a massively successful program created in 2007. And what it does is it offers you forgiveness if you work for a public service employer for 10 years. And so that's a huge benefit to the Attorney General's office, to any government employer, to nonprofit employers. So you know, 501(c)(3) media companies, for example. It's just a huge benefit. And what this rule is doing is erasing the comparative advantage of that benefit. There's just no reason to do public service loan forgiveness if all your loans are going to be forgiven anyway."

The rule is scheduled to go into effect on July 1. Judge Ross said it could take him "a couple of weeks" to make a decision and issue a court order.