JEFFERSON CITY, Mo. — Missouri Governor Mike Parson signed a pair of tax bills into law after calling a special session to address the issue.

On Wednesday, Parson signed Senate Bill 3 and Senate Bill 5, which reduce the state's individual income tax rate and authorize $40 million in annual agricultural tax breaks.

While signing the income-tax-cut legislation Wednesday, Missouri Gov. Mike Parson said the estimated $760 million reduction, when fully phased in, will be “the largest tax cut in the state's history.”

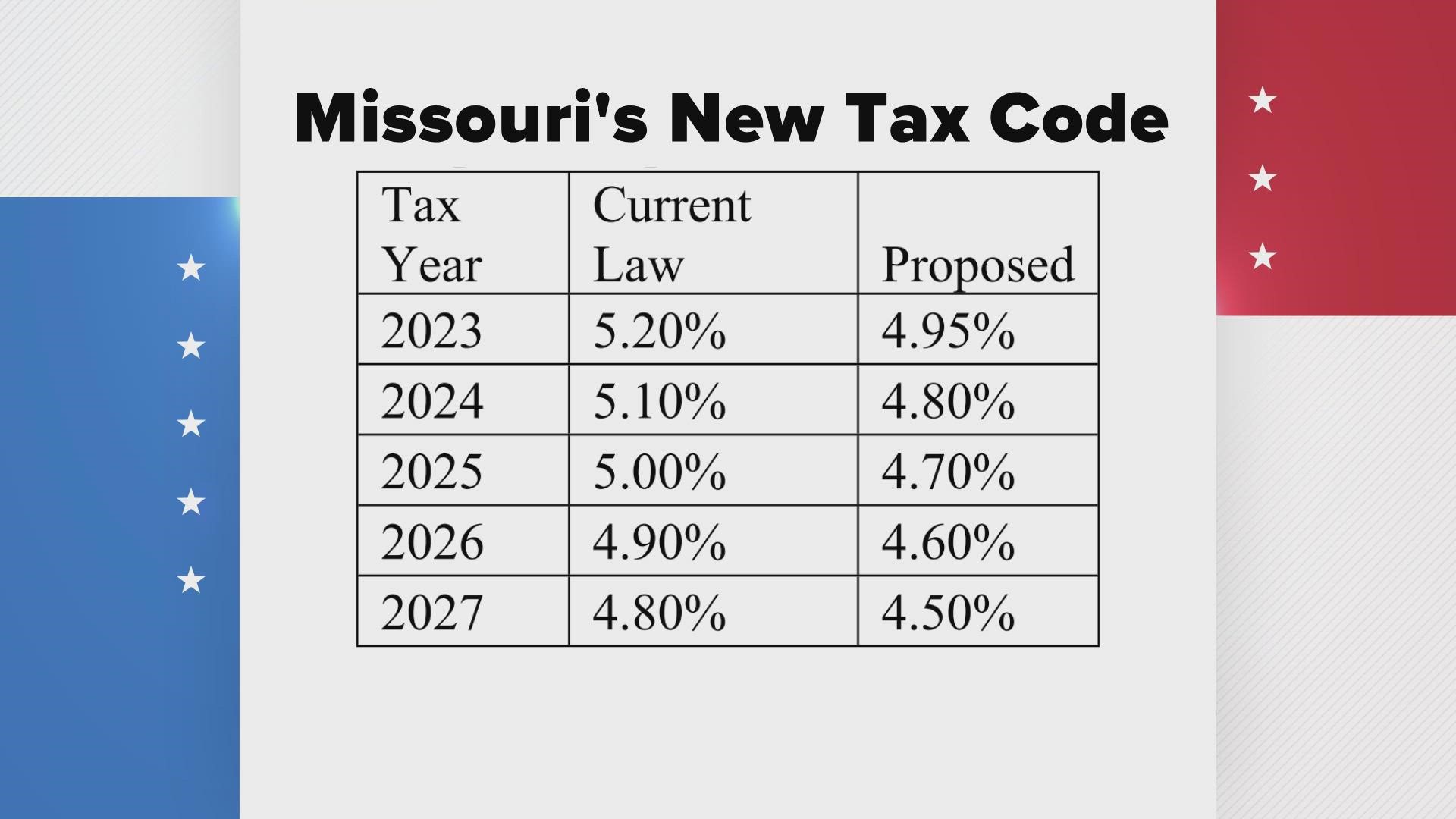

Under previous law, Missouri's top individual income tax rate already was scheduled to fall from 5.3% to 5.2% in January, with the potential to gradually drop to 4.8% if revenue-growth triggers were met in future years.

The new law will cut the tax rate to 4.95% in January and exempt the first $1,000 of income from taxation.

The tax rate could drop to 4.8% as soon as 2024, if state tax revenue grows by at least $175 million over the high mark of the previous three years.

Missouri's new law also authorizes three additional annual tax cuts that could eventually reduce the tax rate to 4.5%.

Each reduction would occur only if state revenue grows by an inflation-adjusted $200 million over the high mark of the previous three years while also exceeding an inflation-adjusted baseline.

Parson said the cuts amount to a 5% reduction in people's taxes. The nonprofit Missouri Budget Project estimates that a household earning $30,000 annually would save $17 next year, and $29 once the law is fully phased in.

For a household earning $152,000 annually, first-year savings would be $348 and eventual savings would reach $759.

Parson also signed a law Wednesday authorizing $40 million of annual agricultural tax breaks benefitting meat processing facilities, urban farmers and biofuel retailers, among others.

More than two dozen other states have passed or are considering tax cuts or rebates in response to an outpouring of federal pandemic aid and their own surging tax revenue.

The bill Missouri lawmakers passed last week and sent to Parson's desk represents a compromise between Republican senators who wanted even deeper tax cuts and those worried about cutting so much that government services might need to be slashed if future revenue collections are not as strong. It does not include an increase to the standard deduction.

The House also on Thursday stripped a last-minute proposal to phase out corporate income taxes.

To watch 5 On Your Side broadcasts or reports 24/7, 5 On Your Side is always streaming on 5+. Download for free on Roku or Amazon Fire TV.