ST. LOUIS — This reporting originally aired in a monologue on The Record, a weekly political show hosted by 5 On Your Side Political Editor Mark Maxwell that takes an in-depth look at politics in Missouri and Illinois.

In a stark display of governmental opacity, the St. Louis Development Corporation (SLDC) has systematically obstructed media efforts to access routine conflict of interest documents, directly contradicting its chairman's repeated public pledges of transparency.

5 On Your Side's investigative reporting has uncovered a disturbing pattern of bureaucratic resistance. Despite SLDC President Neal Richardson's 33 public declarations of transparency during his recent testimony before the Board of Aldermen's Housing and Urban Development and Zoning Committee, the agency's lawyers have responded to a simple public records request with a series of increasingly absurd excuses.

The core issue: conflict of interest forms that should provide public accountability for how taxpayer funds are distributed.

SLDC claims these critical documents, which can reveal the extent to which government officials might have a financial stake in work coming across their desk, are scattered across various departments, stored in hard copies, and would require 15 labor hours to compile—at a cost of at least $300 to the media outlet seeking oversight.

Alderwoman Cara Spencer, who recently resigned from SLDC's board citing her frustration over a lack of transparency, did not mince words: "It's absolutely ridiculous. There's no excuse for that lack of organization in a digital age, in an organization that gets tax dollars. This is an organization charged with driving economic activity for the city."

Spencer, the Ward 8 Democrat who recently filed paperwork to run for mayor next spring, said the way Mayor Tishaura Jones structured SLDC's leadership appointments consolidates too much power in one person and has resulted in shutting the other board members out of vital information about the agency's inner workings.

Jones' administration has disputed Spencer's characterizations and said they followed years of precedent in appointing the same person to hold multiple roles.

The public rift reached a boiling point after weeks of press scrutiny revealed a string of grant awards funneled through SLDC to politically connected families whose applications and qualifications were called into question.

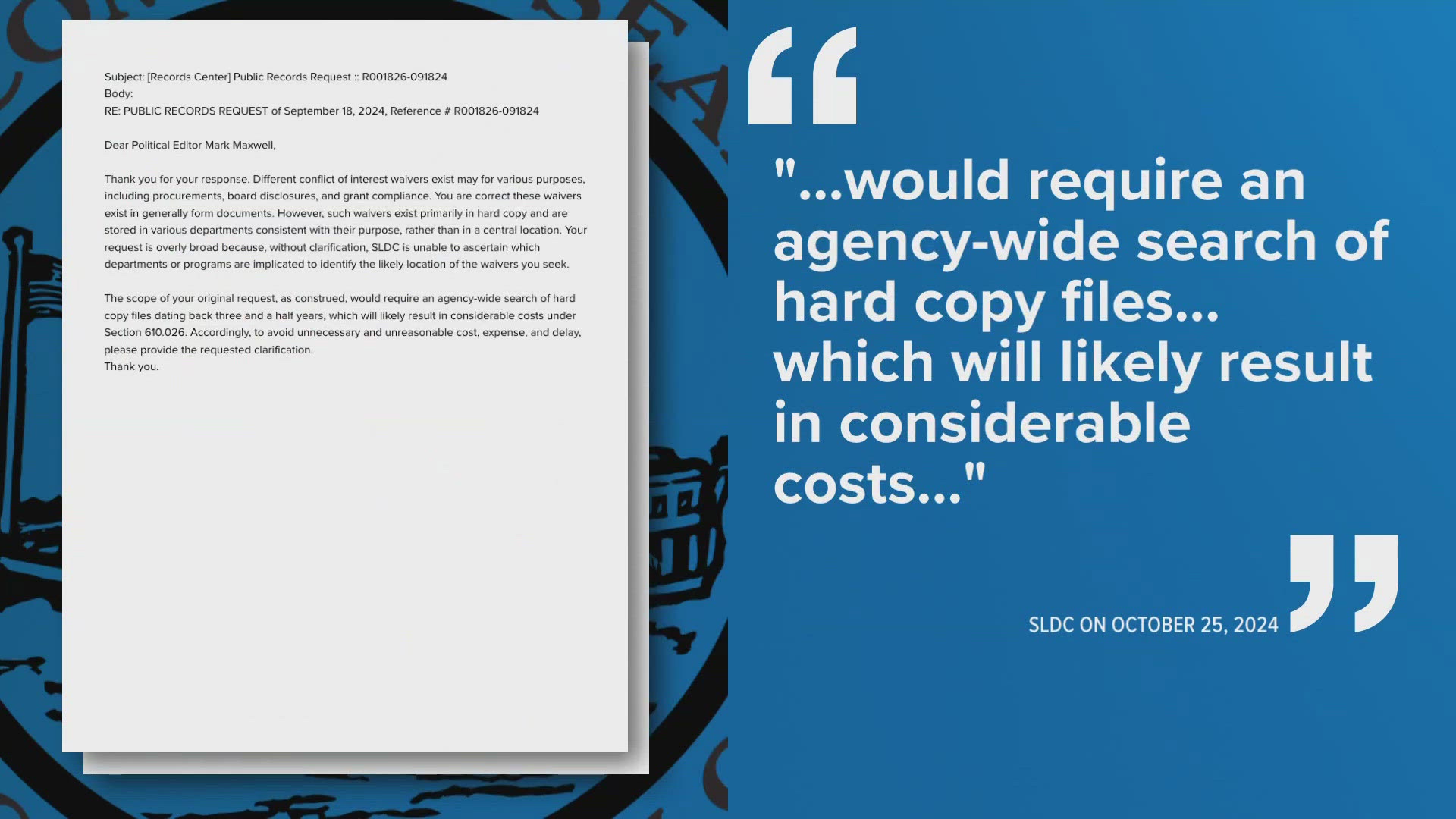

Richardson went on a campaign to shore up public trust by promising renewed commitment to transparency and another round of vetting grant applicants. However, behind the scenes, the agency he runs has been stonewalling requests for months.

A review of the public records request and its correspondence reveals a number of glaring contradictions.

While claiming the records request is "extremely broad" and would require extensive searching, SLDC simultaneously produced nearly 600 pages of conflict of interest waivers—including some from three years ago—and managed to do so relatively quickly.

The agency can manage to find and produce a fraction of the legally required documents, but cannot quickly find the rest of them? How, then, is the board—or the public, for that matter—assured that the documents serve any real function at all?

Most tellingly, SLDC's proposed "transparency" comes with a price tag. Their Nov. 12 response indicates they will only release documents after payment, with a warning that "actual costs for staff time may be higher as research progresses."

While Missouri state law does allow government agencies to impose this transparency tax to reimburse labor costs, the statute also allows the entity to waive the cost when its disclosure is clearly in the public interest. Many agencies opt to comply with open records requests quickly, without throwing up costly hurdles.

This guarded approach stands in sharp contrast to neighboring Illinois, where conflict of interest forms are automatically posted online at the start of every calendar year and immediately accessible through Freedom of Information Act requests.

Because charging the public to see what kind of financial conflicts our government officials have already admitted in writing seems to fly in the face of the spirit of transparency, 5 On Your Side has appealed SLDC's decision to charge a $300 transparency tax.

So far, SLDC has not responded.